Business

A cut tree, a dead elephant, is a lost tourism dollar in the future

by Michel Nugawela and Pesala Karunaratna

(Continued From Last Week)

To increase occupancy rates and avoid economic losses during off-peak seasons, mass tourism suppliers also rely heavily on all-inclusive packages. By inviting tourists to leave their wallets at home and remain within the hotel (typically, the pool, bar and restaurant), they inhibit the dispersion of economic benefits to wider communities or the economically disadvantaged.

For example, mass tourists venturing out of their segregated enclaves to ‘do’ Sigiriya, Polonnaruwa, or Anuradhapura shuttle point-to-point between iconic sites and resorts in the round tour circuit. Individuals and businesses (such as the restaurants, shops, and local transportation services in the vicinity) that aren’t fortunate enough to be part of a package that grants access to this self-contained world receive zero to limited economic benefits. (Studies of all-inclusive packages internationally show that only about 10% of tourism spending directly benefits the local economy.)

Most – if not all – mass tourism suppliers in Sri Lanka also acquire the majority of their business through foreign operators, whose tactics of choice include pitting hotels and resorts against each other to secure the cheapest room rates. It’s much the same with destinations. For example, Lonely Planet’s ‘Best In Travel’ listing ranks its top destinations, regions and cities to visit each year. Sri Lanka took the top spot in 2019 – much to the sectors elation – and yet bear in mind that no single destination is featured in any two consecutive years. Countries are elevated one year, only to be tactically removed in the next. Foreign tour operators also promote destinations to prospective customers – once again, a different destination (or list of destinations) each year – ensuring bargaining power against suppliers/destinations remain stacked in their favour (and with it a high dependency on their global brands, markets, and channels).

Even as the tourism sector languishes through the Covid crisis – which, if anything, should motivate a meaningful search to curtail its own unhealthy overreliance on mass tourism markets – there is still no specific strategy or objective to address the non-differentiation of Sri Lanka’s tourism product. This is not entirely surprising; when footfall is high, the mass tourism sector replicates more of the same; when demand is low, it discounts prices instead of differentiating the product. In a crisis, it simply has no response to the need for better tourists, and a better distribution of tourist by season or location, for the destination.

The untapped potential of alternate tourism

The global tourism sector is expected to return to pre-pandemic tourism levels by 2024 – a slow and lengthy recovery period that has significantly impacted the mass tourism segment. Many consumers have lost wages or jobs, and since travelling will take a larger share of their disposable income, it is extremely unlikely that a rebound in visitor flows will equate with a recovery in visitor spending (expect more cheap all-inclusive packages to lure more cheap tourists). According to international research, the travel behaviour and preferences of the mass tourist will also look different in the future as they take fewer, more memorable trips, with a greater demand for experiences in the outdoors away from crowds.

Meanwhile, high value travellers – the segment Sri Lanka has consistently overlooked in its drive for ‘more’ (volume over value/quantity over quality) – will continue to travel in significant numbers as global mobility returns in 2021. Yet here too, their motivations and behaviours converge on the need for unique and meaningful experiences in nature and wildlife – again, where Sri Lanka has failed to develop and differentiate its product.

Many countries have used the pause this year to rethink their business as usual model and search for answers to important questions such as: will the post-Covid tourists be the kind of visitor we want? Will they improve seasonal spend, stay longer, and disperse economic benefits further into local communities? New Zealand, for example, is ‘reimagining tourism’, with key stakeholders arguing for a value over volume approach to managing tourism numbers while they await an industry recovery. Tourism is New Zealand’s biggest export industry, contributing 20.4% of total exports or 5.8 % of its GDP in 2019.

Meanwhile, Tourism Australia has identified a market opportunity of 80m high value travellers globally, of whom 32mn consider Australia as a destination to visit in the next four years. ‘Nature & Wildlife’ is the #1 driver of destination choice for this demographic from their 14 key inbound markets. This bears repeating: 72% Chinese, 73% Indians, 63% Indonesians, 76% Japanese, 66% Singaporeans, 67% South Koreans, 79% British, 63% US, 74% Germans, 68% Hong Kongers, 65% Malaysians, and 73% New Zealanders from the high value traveller segment visit Australia to experience its nature and wildlife assets.

Malaysia acknowledged the natural wealth of its country to drive revenue even earlier. In 1996, it published its National Ecotourism Plan to attract more visitors and increase visitor spend by developing competitiveness in its nature and wildlife assets. In 2002, nature and wildlife tourism established 10% of the country’s tourism sector; by 2019, this had tripled to 30.4%.

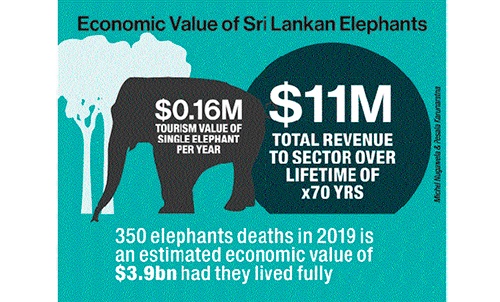

$11m is a wild elephant’s lifelong intrinsic value to tourism

We can no longer be blind to what we are most blessed with. Instead of playing to our strengths, we continue to run a race in a global tourism market where the ten major destinations attract 70% of the worldwide tourism market. It is now time to match our best assets – nature and wildlife – with the best tourists – the high value traveller. And this can be done. Our natural landscapes and attractions boast of the richest species concentration in Asia and one of the highest rates of biological endemism in the world, for both plants and animals.

Consider the wild elephant population: 70% roam outside the protected areas, offering the best viewing opportunities in Asia and representing a huge revenue stream for the tourism sector. We determine the tourism value of a single elephant, alive, to contribute $0.16mn per year. Since elephants live for up to 70 years, the total revenue that a single elephant can generate is immense – $11mn over its lifetime to our hotels, resorts, airlines, travel companies, and – potentially – local economies.

We say potentially, because the value per elephant is significantly diminished under the mass tourism model, where the asset is perceived as an irrelevant pest rather than an important generator of profits. (Conversely, these assets are precisely what high value travellers – who outspend mass tourists by 3-4 times – value most). As global demand rises, therefore, Sri Lanka’s supply diminishes: 350 elephants perished in 2019 – an estimated commercial loss of $3.9bn to the sector, which is the value the animals would have distributed among the recipients in the tourism sector had they lived their lives fully.

Deforestation also dismantles the very assets – animal or plant, elephant or forest – that are required for a product differentiation strategy. When ancient migratory corridors are disrupted, elephants will die. When forests are uprooted, we will no longer be ‘green’ – a fundamental driver of destination choice for high value travellers. When the damage is done – when our natural assets are stripped away – Sri Lanka will no longer be able to position itself as anything other than a cheap destination for sun-sea-sand tourism. The entry of international budget hotel chains over the past half-decade point to our destination relevance in the future.

Amid the increase in deforestation, the silence from the mass tourism sector is deafening, revealing, firstly, just how disconnected its suppliers are from the wider ecology within which they operate, and secondly, the poverty of their vision for the sector and country.

It should come as no surprise, then, that disruption to the mass tourism model has come from the market’s edges rather than any single operator within the mass tourism sector. Dilmah has brought its compelling vision and business strategy to compete against commoditization in the tea industry to the tourism sector. Its luxury offering can generate eight times more revenue per tourist than the mass tourism offering, indicating the potential Sri Lanka has to pivot from mass to class and drive revenue as a destination.

We would question whether it is even possible to carve out other profitable niches without building on Sri Lanka’s strengths in nature. Consider the wellness segment which reconnects consumers to nature through the restorative benefits of ayurvedic medicine and Hela Wedakama, the mindfulness meditation techniques of Buddhism, and yoga retreats. In a short span of time, the segment already accounts for $180mn export revenue (while the spices sector, which has existed for centuries, accounts just $300mn).

A reality check

Sri Lanka is weak or entirely lacking in the underlying enablers of export competitiveness. Without improved FDI flows, the government remains incapable of single-handedly investing in infrastructure and injecting working capital to promote export-driven businesses.

Allocating forest-land to export development (and as the twelve BOI export processing zones remain largely unutilized) dismantles the only competitive advantage Sri Lanka has to compete in international markets and become the primary source of foreign exchange for the country.

By stripping away our nature and wildlife assets, we are left with only our beaches and reputation for cheap sea-sun-sand tourism. The tourism sector is therefore not a fringe player in what happens next – it is right at the centre, because it is these very assets that enable its future competitiveness. We must now urgently commit to a diverse tourism portfolio targetting different tourism segments. A cut tree, a dead elephant, is a lost tourism dollar in the future.

- News Advertiesment

See Kapruka’s top selling online shopping categories such as Toys, Grocery, Flowers, Birthday Cakes, Fruits, Chocolates, Clothing and Electronics. Also see Kapruka’s unique online services such as Money Remittence,News, Courier/Delivery, Food Delivery and over 700 top brands. Also get products from Amazon & Ebay via Kapruka Gloabal Shop into Sri Lanka.

Business

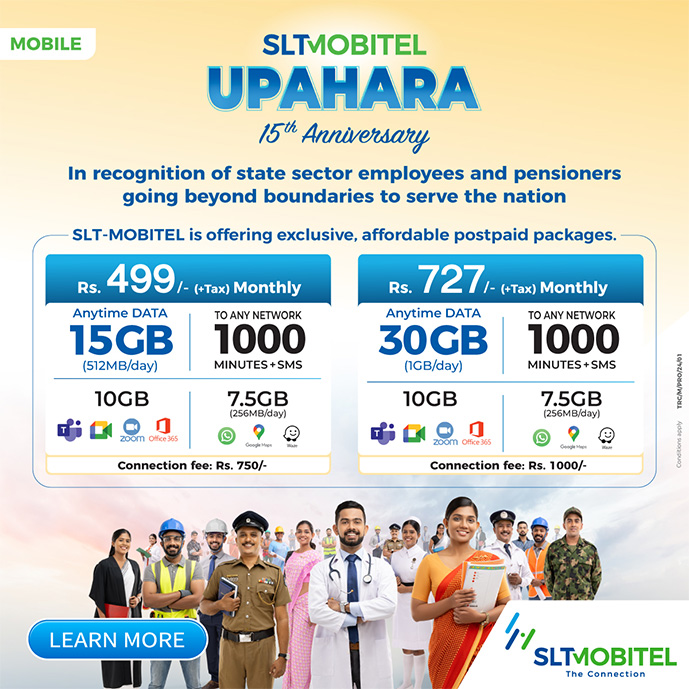

Unlimited music streaming platform in Sri Lanka

SLT-Mobitel, the nation’s ICT and Telecommunications Service Provider recently partnered with Spotify, to mark their launch in Sri Lanka. Spotify is a paid premium music streaming app which allows subscribers to listen to music to their hearts content. Both, SLT-Mobitel Post-Paid and Pre-Paid customers will now be able to enjoy Spotify by activating a monthly recurring subscription or one-time subscription plan and access unlimited music streaming and downloading facilities.

The subscription charges will get added to the user’s customary billing, where payment will be deducted in real time. Starting from the payment date, the user will be able to access Spotify and download their favourite songs, for the next 30 days. Users who sign up for their first monthly subscription will receive an additional one month, courtesy of Spotify. The one-month subscription plan is not applicable with one-time subscription plans. SLT-Mobitel data rates, depending on the user’s respective broadband charges, will apply.

Spotify also has some exciting features that will provide SLT-Mobitel customers with the opportunity to listen to ad-free music, access millions of uninterrupted music under one platform, play any song they like, anywhere they go, and also be able to enjoy their music offline.

SLT-Mobitel customers can select their preferred premium package under four categories; Individual, Duo, Family, Student. Each category has recurring and non-recurring plans. After one month of free streaming, the package will activate once the offer period terminates. While both, the Individual and Student premiums are limited to one account user, the Duo package offers two accounts and the Family premium is accessible through six accounts. To view Spotify plans, users can log on to https://spoti.fi/3aLWvce

Business

Sri Lanka using ‘sovereign power’ over economy: CB Governor

by Sanath Nanayakkare

Anyone conversant with the elements of a political economy would know that Sri Lanka is using its ‘sovereign power’ to manage the different dynamics of the economy in a sustainable manner, Professor W. D Lakshman Governor of the Central Bank said on Wednesday.

“Some critics are saying that we adopt a so-called modern monetary theory. That’s not the case. In fact, Sri Lanka is using its sovereign power in a number of economic aspects to honour its external debt repayment commitments as well as to reduce its debt burden in the medium term as well as achieve resilient growth in the medium to long term, he said.

“We make policy decisions to boost our gross foreign reserves, meet our external debt servicing, to facilitate monetary expansion, to boost our GDP growth, to strengthen our current account balance and manage our domestic and external economic variables in a sustainable manner. This is not a modern monetary theory. This is an age-old tool used by central banks around the world when the circumstances demand it, he said.

“Certain trade-offs will be necessary when dealing with an economy which has a big fiscal gap to bridge. There are efforts to push Sri Lanka towards the IMF again which would in turn have influence on our policymaking. We have taken policy measures to stabilize the economy and we have adequate reserve levels to meet our debt repayments. Meanwhile, we are in negotiations with overseas central banks and multilateral agencies to further boost our reserve level and it would materialise within a matter of weeks,” he noted.

“One of the tools the Central Bank has introduced is in respect of repatriation of export proceeds into Sri Lanka and conversion of such proceeds into Sri Lankan rupees in order to strengthen the foreign exchange situation of the country,” he said.

The Governor made these remarks while delivering the keynote speech at a webinar organised by the Veemansa Initiative led by its Managing Director Luxman Siriwardene – the former Executive Director of Pathfinder Foundation.

The webinar revolved round the topic ‘External debt situation in Sri Lanka: Are we heading for a resolution or crisis?’

Professor Sirimal Abeyratne, Prof. Sumanasiri Liyanage, Dr. Nishan de Mel and Dr. Ravi Liyanage were the other speakers on the panel.

Business

CSE on the rebound; indices close positive

By Hiran H.Senewiratne

CSE produced signs of a rebound yesterday with both indices closing positive, though turnover remained low. Central Bank Governor W.D Lakshman’s recent statement on managing foreign reserves gave some boost to the market yesterday, stock market analysts said.

The index experienced a zigzag movement within the early hours of trading; thereafter, it recorded a slight up-trend as it reached its intraday high of 7,439. Later, the market witnessed a down-trend at mid-day, followed by a sideways movement and closed at 7,372, gaining 43 points during the month of February, market sources said.

It is said the banking sector dominated turnover with a contribution of considerable parcel trades in Sampath Bank, Commercial Bank and HNB.

Further, the Commercial Bank’s impressive quarterly results during the recent turbulent period also built investor confidence. Commercial Bank was able to register a18 percent net interest income when other banks were reporting a decline. Its share price increased by Rs. 3 or 3.5 percent. On the previous day, its shares started trading at Rs. 85 and at the end of the day they moved up to Rs. 88. Due to the positive growth results, the bank announced a Rs. 4.40 dividend per share, plus a Rs. 2 script divergent for every share.

Further, Sampath Bank shares also appreciated in both crossing and retail. In crossings its shares appreciated by Rs. 1.At the end of the day they moved up to Rs. 154.50. In the retail market, its shares moved up by Rs. 2 or 1.3 percent. Previously, its shares fetched Rs. 154 and at the end of yesterday they moved up to Rs. 156.

Amid those developments, both indices moved upwards. The All Share Price Index went up by 104.48 points and S and P SL20 rose by 67.78 points. Turnover stood at Rs. 3 billion with four crossings. Those crossings were reported in Sampath Bank, where 3.9 million shares crossed for Rs. 602.2 million, its share price being Rs. 154.50, HNB 375,000 shares crossed for Rs. 39.4 million, its shares traded at Rs. 105, Pan Asia Power 9.5 million shares crossed for Rs. 33.2 million, its shares traded at Rs. 3.50 and Access Engineering 1.2 million shares crossed for Rs. 28.2 million; its shares traded at Rs. 24.

In the retail market top five companies that mainly contributed to the turnover were, Expolanka Rs. 450 million (10 million shares traded), JKH Rs. 205 million (1.3 million shares traded), Browns Investments Rs. 199 million (34.9 million shares traded), Sampath Bank Rs. 191 million (1.2 million shares traded) and Dipped Products Rs. 137.7 million (2.8 million shares traded). During the day 101 million share volumes changed hands in 18046 transactions.

During the day, Expolanka, the biggest contributor to the turnover, saw its share price appreciating by Rs. 6.20 or 15 percent. Its share price quoted on the previous day was Rs. 41 and at the end of trading yesterday it moved up to Rs. 47.

Sri Lanka’s rupee quoted wider at 193.50/195.50 levels to the US dollar in the spot next market on Thursday while bond yields remained unchanged, dealers said. The rupee last closed in the spot market at 194.50/195.00 to the dollar on Wednesday.