Business

‘Colombo Stock Exchange booms again’

by Dr. Darin Gunesekera

International news report the CSE as a top performing stock exchange in 2021. It is heart warming to Sri Lankans.

The headlines cover much. This exchange in its modern form is now 35 years old. Its related Acts and Regulations, 34 years. In these years there have been fairly minor changes as names, etc only. The substantial structure and Regulatory Act have been the same.

The reason is that these were formulated on the basis of economics after some long hands on study. I decided to do it based on economics only. I added the usual cover gloss of current law. The President at the time gave complete freedom. Actually when shortly afterwards I did the Kenyan system, President Moi gave freedom also. Even when I replaced totally what consultants had then just finalized; after all Harvard Consultancy could not complain that they were left behind by Kenya’s own Yale. And after over 30 years except for allowing trade electronically, there is no substantial change.

And, as in Colombo, great success.

This subject, regulating stock exchanges, was begun by William O’Douglas, a Yale Professor. As he himself said later, and his students carried on as tradition, he had no interest in the economics. He thought the US economy well based. He brought in what he later excelled in as a Supreme Court Justice, rights or human rights. That is the old style in Securities Law.

The modern era was actually pioneered by Dr Tan Cheng Theng, about ten years my senior. He was the best student at Harvard Law School and the editor of the Review. When Lee Kwan Yew went on his sabbatical tour of universities, he recruited Tan to do the “SEC” of Singapore. He did so with some brilliant leaps in where there had been darkness before.

I asked him what he considered important, now for him ten years later, as I wished to incorporate the best. He just expressed disgust of the stockbroking and investment banking business. He told me firmly that he was now a “born again” Christian. I understood the sentiment.

But my great uncle had impressed on me that mathematics was at the heart of the courts of law, which is where the People got their law. And mathematics I knew. I had been tasked to take Professor Smale’s ideas on Economics Maths in Law as a teacher briefly at the Yale Law School. So I knew this did not work easily. So I looked for help. My grandfather had been the leading police officer in the British era and anyway the police are the agents of the law. Tyrrel Gunatilleke was then the leading person in the police. I questioned him and he refused to answer but finally relented and told me how he caught criminals. I had the maths, the real maths. That tight construction was possible. And for all securities, including government, which is now the mainstay of the Kenya exchange.

When in Kenya, I was able to reposition the stock exchange so that it had a much greater social force through these constructions and I am very happy that the exchange has climbed to high regard with simultaneous issues in London and that the lead company on the exchange has over 15BUSD in market value.

Colombo, with no change in laws and regulations has the same capacity. But it must address India. Not long after I left CSE, I visited India where I had as an economist some relations with the civil servant in charge. I noticed that his still old fashioned markets had only one third more than Colombo in capital raising as of then. For all India.

This age is actually now coming to an end. It is often said in America that “Finance and Economics is not Rocket Science”. That is true. Elon Musk has discovered it too. Rocket science is still true to WW2 roots. Real Science and tech are far ahead. Any economics student today has to study Maths and stats beyond a rocket scientist.

Three years or so ago I gave a lecture and spent discussion time in NASA talking of my wealth and poverty field. Our field is there in the Beyond Rocket Science.

Not actually because of high speed trading. The youngster who did the largest trading platform, since sold to Chicago, said to me, “Doctor you don’t understand the economics”. But I learnt and now know. The electronics chases the agio, something Dr Tan as a Christian would have found apalling.

The subject is becoming different.

The moment we move to a transactions base rather than stocks, like the competitive agricultural market from Adam Smith demand and supply to rice or wheat in silos, a conceptual change occurs. It is no longer the market for apples. Actually demand and supply, which never existed except as a construct, now de-constructs. Ask yourself, have you ever seen demand or supply prices. No these change all the time. Where is the economist’s price ?Where is there more market volatility in Colombo today ? At the CSE broker’s office or at Keells Veggie counter ? Clearly at Keells. No CSE stockbroker sells tomatoes at 23 today, at 9 in two days time and then 17 in another two days !

Similarly a share which I used to have in my hand and may be photoed and sent to my mother is now some computer entry or slash hashtag, /***/***/*. Actually like a Dialog bill. You just have to go along. But do you want to?

By newspaper accounts, there were some proposals called MCC. The problem unattended to inside that is one long overdue in hitting developing country markets. The problem is that IT, or conversion to IT identification, will hit with anti-commons or gridlock through our systems from the top. Every computer program redefines the finance. And do we need or want it ?

I just cannot believe it. We want only what is good economics. Not consultant fit talk that hides loss of rights, loss of economic status and dumbing down of owners.

A simple example. The new sets of MIT graduates mainly who have the over all skills and others in Russia and UK and EU who are using SMART skill sets are doing work on the ground and becoming Associate Profs and quietening as the next wave comes.

One in East Africa work spoke with me., and also a young man yet of the old consultancy type. The latter was deeply concerned with water and sanitation. He had got aid agencies to build the sanitary seats but was having difficulty with usage. I suggested he look to the specialists in seat usage. He blinked. I just fumbled with my airline ticket. He got the message. He soon had frequent flyer…

The other was an anti-commons gridlock studies student who did a SMART project in the Congo. I had also talked with the Governor of the Congo Ituri Province virtually, this was in Covid time. And he went on at some length on Covid difficulties. I told him that at least he has no one saying his capital is the Ebola Capital anymore. He smacked his head. “I had clean forgotten”. That is the Congo for you. Well this student approached the municipal council of Kivu which bordered Ituri. Kivu is a typical Congo town. Kivu is in the Congo river basin. This council had problems of tables and chairs, no trash vehicles, etc. The tech kid ignored these trivialities, maths variables of the global set after all are what count. He just set up a SMART system. Suddenly Kivu found itself thick in development. The kid got them to be, without saying so, SMART security issuers and so moving at whatever level of money was around. No multi million dollar system.

Trucks in that area still hard link, that is rod link not chain link, to each other so that they can go through the potholes in those muddy roads. Different to Sri Lanka dirt roads but called the same. They fully immerse to over roof top level in the pot hole mud and just roar their engines and roll on.

Now their finance at least is up to the mark in mathematical construction.

It is a diverse world. So far, the old rod-linked economics has seen our stock exchange weather it all. I hope the Colombo Stock Exchange and its regulator all the best in the future.

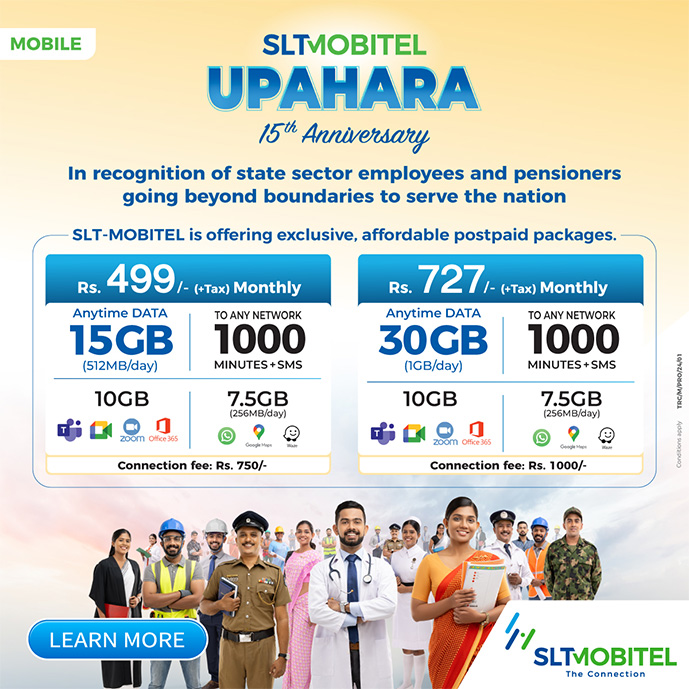

- News Advertiesment

See Kapruka’s top selling online shopping categories such as Toys, Grocery, Flowers, Birthday Cakes, Fruits, Chocolates, Clothing and Electronics. Also see Kapruka’s unique online services such as Money Remittence,News, Courier/Delivery, Food Delivery and over 700 top brands. Also get products from Amazon & Ebay via Kapruka Gloabal Shop into Sri Lanka.

Business

Unlimited music streaming platform in Sri Lanka

SLT-Mobitel, the nation’s ICT and Telecommunications Service Provider recently partnered with Spotify, to mark their launch in Sri Lanka. Spotify is a paid premium music streaming app which allows subscribers to listen to music to their hearts content. Both, SLT-Mobitel Post-Paid and Pre-Paid customers will now be able to enjoy Spotify by activating a monthly recurring subscription or one-time subscription plan and access unlimited music streaming and downloading facilities.

The subscription charges will get added to the user’s customary billing, where payment will be deducted in real time. Starting from the payment date, the user will be able to access Spotify and download their favourite songs, for the next 30 days. Users who sign up for their first monthly subscription will receive an additional one month, courtesy of Spotify. The one-month subscription plan is not applicable with one-time subscription plans. SLT-Mobitel data rates, depending on the user’s respective broadband charges, will apply.

Spotify also has some exciting features that will provide SLT-Mobitel customers with the opportunity to listen to ad-free music, access millions of uninterrupted music under one platform, play any song they like, anywhere they go, and also be able to enjoy their music offline.

SLT-Mobitel customers can select their preferred premium package under four categories; Individual, Duo, Family, Student. Each category has recurring and non-recurring plans. After one month of free streaming, the package will activate once the offer period terminates. While both, the Individual and Student premiums are limited to one account user, the Duo package offers two accounts and the Family premium is accessible through six accounts. To view Spotify plans, users can log on to https://spoti.fi/3aLWvce

Business

Sri Lanka using ‘sovereign power’ over economy: CB Governor

by Sanath Nanayakkare

Anyone conversant with the elements of a political economy would know that Sri Lanka is using its ‘sovereign power’ to manage the different dynamics of the economy in a sustainable manner, Professor W. D Lakshman Governor of the Central Bank said on Wednesday.

“Some critics are saying that we adopt a so-called modern monetary theory. That’s not the case. In fact, Sri Lanka is using its sovereign power in a number of economic aspects to honour its external debt repayment commitments as well as to reduce its debt burden in the medium term as well as achieve resilient growth in the medium to long term, he said.

“We make policy decisions to boost our gross foreign reserves, meet our external debt servicing, to facilitate monetary expansion, to boost our GDP growth, to strengthen our current account balance and manage our domestic and external economic variables in a sustainable manner. This is not a modern monetary theory. This is an age-old tool used by central banks around the world when the circumstances demand it, he said.

“Certain trade-offs will be necessary when dealing with an economy which has a big fiscal gap to bridge. There are efforts to push Sri Lanka towards the IMF again which would in turn have influence on our policymaking. We have taken policy measures to stabilize the economy and we have adequate reserve levels to meet our debt repayments. Meanwhile, we are in negotiations with overseas central banks and multilateral agencies to further boost our reserve level and it would materialise within a matter of weeks,” he noted.

“One of the tools the Central Bank has introduced is in respect of repatriation of export proceeds into Sri Lanka and conversion of such proceeds into Sri Lankan rupees in order to strengthen the foreign exchange situation of the country,” he said.

The Governor made these remarks while delivering the keynote speech at a webinar organised by the Veemansa Initiative led by its Managing Director Luxman Siriwardene – the former Executive Director of Pathfinder Foundation.

The webinar revolved round the topic ‘External debt situation in Sri Lanka: Are we heading for a resolution or crisis?’

Professor Sirimal Abeyratne, Prof. Sumanasiri Liyanage, Dr. Nishan de Mel and Dr. Ravi Liyanage were the other speakers on the panel.

Business

CSE on the rebound; indices close positive

By Hiran H.Senewiratne

CSE produced signs of a rebound yesterday with both indices closing positive, though turnover remained low. Central Bank Governor W.D Lakshman’s recent statement on managing foreign reserves gave some boost to the market yesterday, stock market analysts said.

The index experienced a zigzag movement within the early hours of trading; thereafter, it recorded a slight up-trend as it reached its intraday high of 7,439. Later, the market witnessed a down-trend at mid-day, followed by a sideways movement and closed at 7,372, gaining 43 points during the month of February, market sources said.

It is said the banking sector dominated turnover with a contribution of considerable parcel trades in Sampath Bank, Commercial Bank and HNB.

Further, the Commercial Bank’s impressive quarterly results during the recent turbulent period also built investor confidence. Commercial Bank was able to register a18 percent net interest income when other banks were reporting a decline. Its share price increased by Rs. 3 or 3.5 percent. On the previous day, its shares started trading at Rs. 85 and at the end of the day they moved up to Rs. 88. Due to the positive growth results, the bank announced a Rs. 4.40 dividend per share, plus a Rs. 2 script divergent for every share.

Further, Sampath Bank shares also appreciated in both crossing and retail. In crossings its shares appreciated by Rs. 1.At the end of the day they moved up to Rs. 154.50. In the retail market, its shares moved up by Rs. 2 or 1.3 percent. Previously, its shares fetched Rs. 154 and at the end of yesterday they moved up to Rs. 156.

Amid those developments, both indices moved upwards. The All Share Price Index went up by 104.48 points and S and P SL20 rose by 67.78 points. Turnover stood at Rs. 3 billion with four crossings. Those crossings were reported in Sampath Bank, where 3.9 million shares crossed for Rs. 602.2 million, its share price being Rs. 154.50, HNB 375,000 shares crossed for Rs. 39.4 million, its shares traded at Rs. 105, Pan Asia Power 9.5 million shares crossed for Rs. 33.2 million, its shares traded at Rs. 3.50 and Access Engineering 1.2 million shares crossed for Rs. 28.2 million; its shares traded at Rs. 24.

In the retail market top five companies that mainly contributed to the turnover were, Expolanka Rs. 450 million (10 million shares traded), JKH Rs. 205 million (1.3 million shares traded), Browns Investments Rs. 199 million (34.9 million shares traded), Sampath Bank Rs. 191 million (1.2 million shares traded) and Dipped Products Rs. 137.7 million (2.8 million shares traded). During the day 101 million share volumes changed hands in 18046 transactions.

During the day, Expolanka, the biggest contributor to the turnover, saw its share price appreciating by Rs. 6.20 or 15 percent. Its share price quoted on the previous day was Rs. 41 and at the end of trading yesterday it moved up to Rs. 47.

Sri Lanka’s rupee quoted wider at 193.50/195.50 levels to the US dollar in the spot next market on Thursday while bond yields remained unchanged, dealers said. The rupee last closed in the spot market at 194.50/195.00 to the dollar on Wednesday.