Opinion

Financial institutions under pressure to lend: A dangerous trend

In 2008, the housing crisis in the United States caused a global credit crunch that was felt all around the world including the US and the UK but also Russia, Ireland, Mexico and several Baltic states. The crisis was truly global, yet Sri Lanka was spared the worst effects of the crisis for various reasons primarily due to the regulatory structure which restricted exposure to high risk financial assets. The financial crisis did create issues for Sri Lanka’s exports, and, generally speaking, there was a drop in both the prices of and demand for commodities. Sri Lanka nonetheless survived the financial crisis and even thrived for a few years following the defeat of terrorism.

Yet, Sri Lanka may have another looming crisis and it is not the property ‘bubble’. While the property market is currently lacking in liquidity, there is adequate room for upward social mobility from the working classes and there is demand in many sub-sectors of the property market. Perhaps, there will be an oversupply of luxury condominiums sometime in the near future, but this too is a small market segment when compared to the property market as a whole. Further, the mortgage industry is also heavily regulated and banks generally discount the value of a property it is lending against.

Sri Lanka may however face more severe issues in the near future with the level of personal debt that many Sri Lankans have taken on. From the point of view of the financial institutions, unsecured credit card debt is perhaps the major threat to the stability of the system. As per a report from October 2018, Sri Lanka’s total credit card debt stood at Rs. 101 Bn. A report in April 2019 showed that total credit card debt had increased further to Rs. 109 Bn, which is an Rs. 8 Bn increase in 7 months. Since April 2019, the overall economic performance of Sri Lanka has suffered at least two major setbacks. First, the Easter Sunday Attacks, which created a dramatic drop in tourist arrivals, a major income earner for Sri Lanka and an industry that employs millions directly and indirectly. Second, just as the country’s economy seemed set for a revival, the Covid19 pandemic struck, affecting tourism specifically but virtually every other industry as well.

Many Sri Lankans had no choice but to resort to utilising any debt instrument available to them in order to make ends meet. There is little doubt that many Sri Lankans would have opted to utilise the available balances on their credit cards, plunging them further into debt with even higher interest rates and expensive penalties and charges.

Even if we assume that credit card debt in total would ‘only’ be around Rs. 120 Bn at this point in time, we have to also consider other forms of personal debt. Most mortgages are well secured due to the discounting requirements from the CBSL; thus even in the unlikely event that there would be a crash in the property market, most lenders will be well collateralised. This is not the case with credit cards, and exposure to the credit card sector is significant across banks of all sizes at all tiers.

Yet, this still only part of the problem. Consider personal loans, though quantums are smaller, the risk is high for the lending institutions as more often than not, personal loans are unsecured and usually borrowed for consumerist purposes. Most people in Sri Lanka buy durables including televisions, washing machines, etc., on consumer finance schemes, and again some of this risk is taken by banks and other lending institutions. The durable item will often be obsolete in a year or two, so any default is unlikely to be covered by the value of the goods. Education loans are another instrument which many consumers use to fund their educational pursuits or those of their children. Often these too are unsecured and only linked to monthly income. Thus, considering credit card debt plus other forms of unsecured personal debt, both Sri Lankan borrowers and the lending institutions might well be engaging in an unstoppable ‘snow-ball’ effect.

Yet, this still only part of the problem. Consider personal loans, though quantums are smaller, the risk is high for the lending institutions as more often than not, personal loans are unsecured and usually borrowed for consumerist purposes. Most people in Sri Lanka buy durables including televisions, washing machines, etc., on consumer finance schemes, and again some of this risk is taken by banks and other lending institutions. The durable item will often be obsolete in a year or two, so any default is unlikely to be covered by the value of the goods. Education loans are another instrument which many consumers use to fund their educational pursuits or those of their children. Often these too are unsecured and only linked to monthly income. Thus, considering credit card debt plus other forms of unsecured personal debt, both Sri Lankan borrowers and the lending institutions might well be engaging in an unstoppable ‘snow-ball’ effect.

Against this backdrop, it is with some consternation that we note the comments made by the Minister of Industries Wimal Weerawansa, at a business conference, held at the BMICH, a few days ago. During the event he stated that he has “not seen such rigid policies when lending to entrepreneurs or industry like in this island” while also alluding to the annual profits of some banks which are over Rs. 3 Bn in some cases. Mr. Weerawansa did not, however, point out that Sri Lanka’s largest state bank, the Bank of Ceylon reported a loss of Rs. 300 Mn for the quarter ended June 2020. Sampath Bank saw its profits drop by 36% for that same quarter. Cargills Bank made a 64 Mn loss in Q2 2019 and the June 2020 quarter also saw non-performing loans (NPL) increase to 5.3% of total loans industry wide. This is all before the worst effects of the pandemic driven lockdown can be baked into the numbers. Indeed, many banking professionals expect further provisioning and write-offs in the coming year.

The Minister also stated that the banks in Sri Lanka were less interested in lending to industries. What he perhaps meant to say was that lending on industrial projects was restricted. However, economists agree that many of Sri Lanka’s major industries; tourist hotels, hydro-power, garments and other manufacturing related projects have all been heavily backed by bank finance. He went on to say that the CBSL “has developed a lot of monetary policy for the benefit of the bankers and not for the benefit of the clients…” This once again is a mischaracterisation of the structure of the system. Banks are run through depositors’ funds and the depositors are Sri Lankan citizens; it is their money that the banks lend with margins under strict guidelines. The CBSL’s main duty is to protect the hard earned money that citizens deposit in the banks.

It is very important that we understand the current predicament in its entirety before making such comments which are quite clearly meant to put pressure on financial institutions to lend more funds. Veterans of the banking industry are well aware that banks are one of the key drivers of economic activity in any economy, but more so in Sri Lanka where FDI has been lagging for many years.

The shareholders of banks do not own the funds that are being lent; it is the citizen’s deposits that are being lent. In basic terms, banks take funds as deposits; on demand, on short-term tenors and on medium to long term tenors. Banks must be cautious about lending funds even on a short term basis if their funding structure is tilted towards demand deposits. Capital adequacy will not be anywhere near enough if ad hoc lending strategies are given priority. A lender’s major task is to identify the borrower and their risk profile verses the steps that can be taken to mitigate risk. The important term here is to mitigate risk, not to altogether absolve yourself from the risk.

There are three broad categories of borrower:

1. Those who borrow with a genuine desire to repay

2. Those who borrow on the basis of repaying ONLY if the project or investment becomes a success

3. Those who borrow with the idea of not repaying no matter the circumstance.

Once you identify your customer and what category he falls into, you must then take a view on the risk proposition versus the profit motives and act accordingly. This is no easy task. At this current stage in our country’s recovery from the Easter attacks and the pandemic, increased lending even at lower interest rates can lead to serious instability in the system. In fact, the worst is likely still to come, considering that moratoriums are expiring at the end of September and the country’s economy has yet to show signs of a sustained recovery. Wages have fallen due to the lack of business activity, disposable incomes are non-existent, personal debt is on the rise, and non-performing loans are also increasing.

Yes, the banks in Sri Lanka have been very successful in the past and the industry is perhaps one of the most stable and dynamic in the country’s history. However, this is as a result of very carefully crafted policy and strict regulations. If anyone goes back a few decades to the height of terrorism in the nation, it is the banks that guaranteed some form of economic progress to the country’s people and its industry. Thus I urge the Minister and his colleagues not to be so brash as to think that the country, its people and its industry can survive and thrive on borrowings alone. The state and its institutions should provide a framework for success, beyond tax holidays and low interest rates. Consistency of policy, stability of currency, multi-stakeholder planning of key industries and attracting both FDI and foreign talent to the country are just some of the facets that must all come together before we start looking at enhancing lending portfolios to spur economic growth.

Rienzie Wijetilleke & Kusum Wijetilleke

– Colombo 7

rienzietwij@gmail.com

- News Advertiesment

See Kapruka’s top selling online shopping categories such as Toys, Grocery, Flowers, Birthday Cakes, Fruits, Chocolates, Clothing and Electronics. Also see Kapruka’s unique online services such as Money Remittence,News, Courier/Delivery, Food Delivery and over 700 top brands. Also get products from Amazon & Ebay via Kapruka Gloabal Shop into Sri Lanka.

Opinion

Take Human Rights seriously, not so much the council or office

By Dr Laksiri Fernando

The 46th Session of the UN Human Rights Council started on 22 February morning with obvious hiccups. The Office, to mean the Office of the UN High Commissioner for Human Rights, finally decided to hold all sessions virtually online, only the President of the Council and the assistants in the high table sitting at the UN Assembly Hall in Geneva. The President, Ms. Nazhat Shammen Khan, Ambassador from Fiji in Geneva, wearing a saree, was graceful in the chair with empty seats surrounding.

In the opening session, the UN General Assembly President, UN General Secretary, UN High Commissioner for Human Rights, and Head of Foreign Affairs, Switzerland (as the host country), addressed remotely the session. In fact, there was no need for Switzerland to have a special place, as the UN is independent from any host country. Switzerland is fairly ok, however, if this tradition is followed, the UN General Assembly may have to give a special place to the US in New York.

Initial Addresses

UN General Secretary, Antonio Guterres’ address could have been quite exemplary if he gave a proper balance to the developed and developing countries. He talked about racism and fight against racism but did not mention where racism is overwhelmingly rampant (US and Europe) and what to do about it. Outlining the human rights implications of Covid-19 pandemic, he made quite a good analysis. It was nice for him to say, ‘human rights are our blood line (equality), our lifeline (for peace) and our frontline (to fight against violations).’ However, in the fight against violations, he apparently forgot about the ‘blood line’ or the ‘lifeline’ quite necessary not to aggravate situations through partiality and bias. He never talked about the importance of human rights education or promoting human rights awareness in all countries.

His final assault was on Myanmar. Although he did not call ‘genocide,’ he denounced the treatment of Rohingyas as ethnic cleansing without mentioning any terrorist group/s within. His call for the release of Aung San Suu Kyi and other civilian leaders undoubtedly should be a common call of all. However, he did not leave any opening for a dialogue with the military leaders or bring back a dialogue between Aung San and Min Aung, the military leader. With a proper mediation, it is not impossible. Calling for a complete overhaul as the young demonstrators idealistically claim might not be realistic.

High Commissioner Michelle Bachelet’s address was brief and uncontroversial this time without mentioning any country or region. It is clear by now perhaps she is not the real author of the Report against Sri Lanka, but someone probably hired by the so-called core-group led by Britain. Her major points were related to the coronavirus pandemic trying to highlight some of the socio-economic disparities and imbalances of policy making that have emerged as a result. The neglect of women, minorities, and the marginalized sections of society were emphasized. But the poor was not mentioned. As a former medical doctor, she also opted to highlight some of the medical issues underpinning the crisis.

High Commissioner Michelle Bachelet’s address was brief and uncontroversial this time without mentioning any country or region. It is clear by now perhaps she is not the real author of the Report against Sri Lanka, but someone probably hired by the so-called core-group led by Britain. Her major points were related to the coronavirus pandemic trying to highlight some of the socio-economic disparities and imbalances of policy making that have emerged as a result. The neglect of women, minorities, and the marginalized sections of society were emphasized. But the poor was not mentioned. As a former medical doctor, she also opted to highlight some of the medical issues underpinning the crisis.

Then came the statements from different countries in the first meeting in the following order: Uzbekistan, Colombia, Lithuania, Afghanistan, Poland, Venezuela, Finland, Fiji, Moldova, Georgia, Kazakhstan, Equatorial Guinea, Vietnam, Belgium, and Morocco. The obvious purposes of these statements were different. Some countries were apparently canvassing for getting into the Human Rights Council at the next turn perhaps for the purpose of prestige. Some others were playing regional politics against their perceived enemies. This was very clear when Lithuania and Poland started attacking Russia.

But there were very sincere human rights presentations as well. One was the statement by the President of Afghanistan, Mohammad Ashraf Ghani. He outlined the devastating effects that Afghanistan had to undergo during the last 40 years, because of foreign interferences. The initial support to Taliban by big powers was hinted. His kind appeal was to the UN was to go ‘beyond discourse to practice’ giving equal chance to the poor and the developing countries to involve without discrimination.

Controversial Presentations

China’s Foreign Affairs Minister, Wang Yi, made his presentation almost at the end of the first day. This is apparently the first time that China had directly addressed the Human Rights Council. Beginning with outlining the devastating repercussions of the coronavirus pandemic he stressed that the world should face the challenges through ‘solidarity and cooperation.’ He broadened the concept to human rights solidarity and cooperation. His expressed views were quite different to the others, particularly to the Western ones.

He frankly said that what he expresses are the views of China on human rights without claiming those are absolute truths or forcing others to believe or implement them. There were four main concepts that he put forward before the member countries. First, he said, “We should embrace a human rights philosophy that centres on the people. The people’s interests are where the human rights cause starts and ends.” Second, he said, “we should uphold both universality and particularity of human rights. Peace, development, equity, justice, democracy, and freedom are common values shared by all humanity and recognized by all countries.” “On the other hand,” he said, “countries must promote and protect human rights in light of their national realities and the needs of their people.”

“Third,” he said, “we should systemically advance all aspects of human rights. Human rights are an all-encompassing concept. They include civil and political rights as well as economic, social, and cultural rights.” He then emphasized, “Among them, the rights to subsistence and development are the basic human rights of paramount importance.” Fourth, “we should continue to promote international dialogue and cooperation on human rights. Global human rights governance should be advanced through consultation among all countries.”

It was on the same first day before China, that the United Kingdom launched its barrage against several countries not sparing Sri Lanka. The Foreign Secretary, Dominic Raab, delivered the statement from top to bottom attacking alleged violating countries on human rights. But there was no mentioning of Israel for the repression of Palestinians or the systemic racism rampaging in the United States, including the 6 January attacks on the Capitol by extremist/terrorist groups.

His first sermon was on Myanmar without acknowledging the British atrocities or mismanagement of this poor and diverse country during the colonial period. He was quite jubilant over implementing sanctions and other restrictions over the country. Many sanctions, in my opinion, are extortions. Undoubtedly, Aung San Suu Kyi and other leaders should be released, and democracy restored. This is a task of the whole council and when one or two countries try to grab the credit, there can be obvious reservations of others.

His further scathing attacks were against Belarus, Russia, and China. Some appeared factually correct but not necessarily the approach or the motives genuine. The following is the way he came around Sri Lanka. He said,

“Finally, we will continue to lead action in this Council: on Syria, as we do at each session; on South Sudan; and on Sri Lanka, where we will present a new resolution to maintain the focus on reconciliation and on accountability.”

‘Action’ to him basically means repeatedly passing resolutions, of course imposing economic and other sanctions. He said, “as we do at each session”; like bullying poor or weak countries at each session. Can there be a resolution against Russia or China? I doubt it.

What would be the purpose of presenting a resolution against Sri Lanka? As he said, “to maintain the focus on reconciliation and on accountability.” This will satisfy neither the Tamil militants nor the Sinhalese masses. But it might satisfy the crafty Opposition (proxy of the defeated last government). This is not going to be based on any of the actual measures that Sri Lanka has taken or not taken on reconciliation or accountability. But based on the ‘Authoritarian and Hypocritical Report’ that some anti-Sri Lankans have drafted within the Office of the High Commissioner for Human Rights. This what I have discussed in my last article.

In this context, successful or not, the statement made by the Sri Lanka’s Minister of External Affairs, Dinesh Gunawardena, in rejecting any resolution based on the foxy Report of the Office of the UN High Commissioner for Human Rights, in my concerned opinion, is absolutely correct.

Opinion

President’s energy directives ignored by the Power Ministry: Another Point of View

Dr Tilak Siyambalapitiya

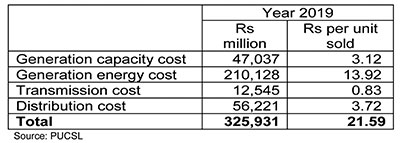

Dr Janaka Rathnasiri laments (The Island 19 Feb 2021) that the Power Ministry has ignored the President’s directive to draw 70% of energy from renewable sources by 2030. I saw the approved costs of electricity production for 2019, published by the Public Utilities Commission (PUCSL).

PUCSL has also approved the prices to sell electricity to customers. Although various customers pay at various “approved” prices, the average income from such “approved” prices in 2019 was Rs 17.02 per unit. It is not only the Ministry, according to Dr Rathnasiri, ignoring the President; PUCSL is also breaking the law, which says prices and approved costs should be equal.

So there is already an illegal gap of Rs 21.59 minus 17.02 = Rs 4.57 per unit of electricity sold. If electricity prices are not to be increased, as stated by many in the government and PUCSL, let us say the following: Distribution costs should decrease by 0.57 Rs per unit. Generation costs should decrease by Rs 4.00 per unit.

So there is already an illegal gap of Rs 21.59 minus 17.02 = Rs 4.57 per unit of electricity sold. If electricity prices are not to be increased, as stated by many in the government and PUCSL, let us say the following: Distribution costs should decrease by 0.57 Rs per unit. Generation costs should decrease by Rs 4.00 per unit.

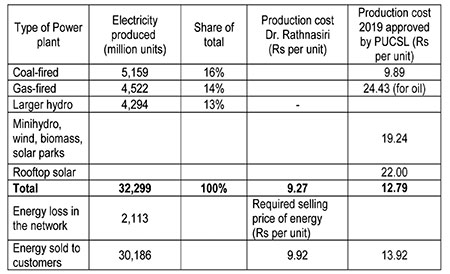

PUCSL also published the approved cost of purchasing or producing electricity from various sources for 2019. The actual energy values were different to what was approved, but let us stick to PUCSL approved figures:

I suggest Dr Rathnasiri fills-up the following table, to show how much electricity will cost in 2030 to produce and deliver, if the President’s 70% target is to be achieved and for PUCSL to abide by the law. Let us assume that electricity requirement in 2030 will be double that of 2019.

Since PUCSL has to save Rs 4 from 13.92, the average selling price for energy should be Rs 13.92 minus 4.00 = Rs 9.92. With a target network loss of 7% (in 2019 it was 8.4%), the average cost of production has to be Rs 9.27 per unit. Eight cages have to be filled-up by Dr Rathnasiri.

Since PUCSL has to save Rs 4 from 13.92, the average selling price for energy should be Rs 13.92 minus 4.00 = Rs 9.92. With a target network loss of 7% (in 2019 it was 8.4%), the average cost of production has to be Rs 9.27 per unit. Eight cages have to be filled-up by Dr Rathnasiri.

In 2012, PUCSL approved the energy cost of electricity produced from coal power to be 6.33 Rs per kWh. In 2019, PUCSL approved 9.89 (56% increase). For renewable energy, it was 13.69 in 2012, and 19.24 in 2019 (a 40% increase, but double the price of electricity from coal fired generation). In 2012, rooftop solar was not paid for: only give and take, but now paid Rs 22, against Rs 9.89 from coal. There seems to be something wrong. The price reductions of renewable energy being promised, being insulated from rupee depreciation, are not happening? Either Sri Lanka must be paying too little for coal, or it may be renewable energy is severely over-priced?

On coal we hear only of some corruption every now and then; so Sri Lanka cannot be paying less than it costs, for coal.

Enough money even to donate

vaccines

Another reason for the Ministry of Power to ignore the President’s directive may be the Ministry’s previous experience with similar Presidential directives. In 2015, the President at that time cancelled the Sampur coal-fired power plant, and the Ministry faithfully obliged. That President and that Prime Minister then played ball games with more power plants until they were thrown out of power, leaving a two-billion-dollar deficit (still increasing) in the power sector. Not a single power plant of any description was built.

Another reason for the Ministry of Power to ignore the President’s directive may be the Ministry’s previous experience with similar Presidential directives. In 2015, the President at that time cancelled the Sampur coal-fired power plant, and the Ministry faithfully obliged. That President and that Prime Minister then played ball games with more power plants until they were thrown out of power, leaving a two-billion-dollar deficit (still increasing) in the power sector. Not a single power plant of any description was built.

Where is this deficit? You do not have to look far. In the second table, replace 24.43 with 9.89, to reflect what would have happened if Sampur was allowed to be built. The value 12.79 will go down to 8.55, well below the target of Rs 9.27 per unit to produce. Not only would CEB and LECO report profits, but the government too could have asked for an overdraft from CEB to tide over any cash shortfalls in the treasury. All this with no increase in customer prices. Producers of electricity from renewable energy could enjoy the price of 19.24 Rs per unit. And that blooming thing on your rooftop can continue to enjoy Rs 22 per unit. The Minister of Power, whom Dr Rathnasiri wants to replace with an army officer, would have been the happiest.

In the absence of Sampur (PUCSL’s letter signed by Chairman Saliya Mathew confirmed cancellation and asked CEB not to build it), PUCSL approved electricity to be produced at Rs 21.59 and sold at Rs 17.02 per unit. The annual loss would be Rs (21.59 – 17.02) x 15,093 = Rs 69 billion per year of approved financial loss. Sri Lanka has a Telecom regulator, an Insurance regulator, a Banking regulator, who never approve prices below costs. Sometime ago the telecom regulator asked the operators to raise the prices, when operators were proposing to reduce prices amidst a price war. But the electricity industry regulator is different: he approves costs amounting to 27% more than the price, not just once but, but continuously for ten long years !

In the absence of Sampur (PUCSL’s letter signed by Chairman Saliya Mathew confirmed cancellation and asked CEB not to build it), PUCSL approved electricity to be produced at Rs 21.59 and sold at Rs 17.02 per unit. The annual loss would be Rs (21.59 – 17.02) x 15,093 = Rs 69 billion per year of approved financial loss. Sri Lanka has a Telecom regulator, an Insurance regulator, a Banking regulator, who never approve prices below costs. Sometime ago the telecom regulator asked the operators to raise the prices, when operators were proposing to reduce prices amidst a price war. But the electricity industry regulator is different: he approves costs amounting to 27% more than the price, not just once but, but continuously for ten long years !

That is 370 million dollars per year as of 2019, the economy is spending, and for years to come, to burn oil (and say we have saved the environment). Did the Minister of Health say we are short of 160 million dollars to buy 40 million doses of the vaccine? Well, being a former Minister of Power, she now knows which Presidential “order” of 2015 is bleeding the economy of 370 million dollars per year, adequate to buy all vaccines and donate an equal amount to a needy country.

Prices are the production costs approved by PUCSL for 2019. The selling price approved by the same PUCSL was Rs 9.27 per unit.

Opinion

Confusion on NGOs and NSOs in Sri Lanka

If you listen to politicians and journalists here, you will hear of that curious creature rajya novana sanvidane, a Non-State Organization (NSO). Where do you get them? In the uninstructed and dead minds of those who use those terms. In the real world, where politicians and journalists have developed minds, there are Non-Governmental Organizations (NGO). The United Nations is an organization set up by state parties, not by governments. It is true that agents of states, governments, make the United Nations work or fail. Governments may change but not the states, except rarely. When Eritrea broke away from Ethiopia, a new state was formed and was so recognised by the United Nations. However, the LTTE that tried to set up another state was crushed by the established state that it tried to break away from, and the UN had nothing to do with them.

This entirely unnecessary confusion, created out of ignorance, is so destructive that organizations completely loyal to the existing state, are made to be traitorous outfits, for they are ‘non-state organizations’ within the state. There are citizens of each state, but no citizens of any government. Government is but an instrument of the state. In most states there are organizations, neither of the state nor of government: religious organizations including churches. But none of them is beyond the pale of the state.

Those that speak of rajya novana sanvidane give that name partly because they have no idea of the origin of non-governmental organizations. NGOs came into the limelight, as donor agencies, noticed that some governments, in East Africa, in particular, did not have the capacity and the integrity to use the resources that they provided. They construed, about 1970, that NGOs would be a solution to the problem. Little did they realize that some NGOs themselves would become dens of thieves and brigands. I have not seen any evaluation of the performance of NGOs in any country. There was an incomplete essay written by Dr. Susantha Gunatilleka. NGOs are alternatives to the government, not to the state.

Our Constitution emphatically draws a distinction between the government and state, and lays down that the President is both Head of Government and Head of State (Read Article 2 and Article 30 of the Constitution.) It is as head of state that, he/she is the Commander of the Armed Forces, appoints and receives ambassadors and addresses Parliament annually, when a prorogued Parliament, reconvenes. He/she presides over the Cabinet as head of government. The distinction is most clear, in practice, in Britain where Queen Elizabeth is the head of state and Boris Johnson is the Prime Minister and head of government. However, in principle, Johnson is the Queen’s First Minister appointed by the sovereign, and resigns by advising her of his decision to do so.

In the US and in India the term ‘state’ has special significance. In India there is a ‘rajya sabha’ (the Council of States) whose members represent constituent States and Union Territories. Pretty much the same is true of the United States. In the US, executive power is vested in the President and heads the administration, government in our parlance. The Head of State does not come into the Constitution but those functions that one associates with a head of state are in the US performed by the President of the Republic. The US President does not speak of my state (mage rajaya) but of my administration, (mage anduva). Annually, he addresses Congress on the State of the Union. Our present President must be entirely familiar with all this, having lived there as a citizen of the US for over a decade. It is baffling when someone speaks of a past state as a traitor to that same state. It is probable that a government was a traitor to the state. ‘Treason against the United States, shall consist only in levying war against them, or in adhering to their (States’) enemies, giving them aid and comfort’. That a state was a traitor to the same state is gobbledygook.

Apart from probable confusion that we spoke of in the previous paragraph, it is probable that a president and other members of a government, including members of the governing party here, find it grandiloquent to speak of his/her/their state (mage/ape rajaya), rather than my government (mage anduva) or Sirisena anduva’ and not Sirisena state; it was common to talk of ‘ape anduva’ in 1956; politicians in 1956 were far more literate then than they are now.

When translating from another language, make sure that you understand a bit of the history of the concept that you translate. A public school in the US is not the same as a public school in the UK.

MAHADENAMUTTA