Business

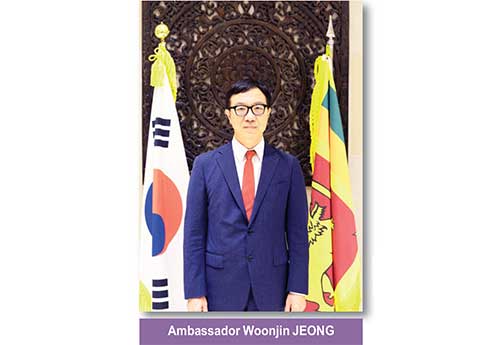

Korea could assist SL to reach pinnacle of development – Ambassador Woonjin JEONG

By Lynn Ockersz

‘The time is right for Sri Lanka to change and take a leap to a higher level. Korea is the very country that can assist Sri Lanka to reach the pinnacle of national development and prosperity. Korea’s economic miracle, “The Miracle on the Han River” is a story of overcoming many hardships by the Korean people that led to Korea’s national transformation from poverty to prosperity. As a true friend, Korea would like to share the technological know-how and resources to help Sri Lanka to achieve “the Miracle on the Kelani River”, ambassador to the Republic of Korea in Sri Lanka Woonjin JEONG said.

Speaking to ‘The Island Financial Review’ recently in an exclusive interview ambassador JEONG also said that besides providing growing markets for Sri Lanka’s rubber, coconuts, graphite and apparels, among many other items, Korea-Sri Lanka tourism links are another area in bilateral economic ties that could be further developed. He said that 13,000 Koreans visited Sri Lanka last year. ‘But this is only 0.5 per cent of the total tourism in Korea.’

The interview:

In which broad directions do you hope to take Korea-SL ties?

Since the establishment of diplomatic relations in 1977, Korea and Sri Lanka have come a long way together to form a cordial bilateral partnership. We have been true friends to each other. Our relations have much potential to grow.

Sri Lanka is not only one of Korea’s priority ODA cooperation partner countries, but also one of the top five countries that are benefitted from the Economic Development Cooperation Fund of Korea. The sum of investment in various ODA projects and grants for Sri Lanka since 1987 is over one billion USD. The Sri Lanka office of KOICA has assisted and funded commercial and infrastructure projects of Sri Lanka in the various fields such as education, transportation, water resources, sanitation and regional development in Sri Lanka.

The engagement in labour cooperation has also been impressive in recent years. 23,000 Sri Lankan employees are presently in Korea. Around 520 million US dollars were transmitted by them from Korea to Sri Lanka last year. They greatly contribute to the economic advancement of both countries. Since COVID-19 outbreak, the process of departure to Korea for employment has been suspended. However, it resumed last September and I invited the first batch of Sri Lankan migrant workers who were going to the Republic of Korea to express my appreciation for their contribution to uplift the economies of both countries.

Our cultural exchanges also have intensified over the years. The Korea Week 2020 was conducted virtually on digital platforms to provide an immersive experience of the Korean culture. I witnessed the enthusiasm and interest among the Sri Lankan participants. It is evident that our cultural bonds have grown stronger over the years.

I hope to further expand our economic ties, labour cooperation and cultural exchanges during my term as Ambassador to Sri Lanka.

What are the best investment opportunities for Korean corporates in SL?

Korea was Sri Lanka’s biggest foreign investor during the 1980s and early 90s. I believe that it is an opportune moment for Korea and Sri Lanka to revive investments, learn from each other’s experiences and intensify mutually beneficial trade and FDI. Sri Lanka is endowed with natural resources and high quality human resources which are very complimentary with the capital and technology of Korea.

The South Korean economy is the 10th largest in the world with a GDP of $1.6 billion; the exports have increased by 750 times between 1970 and 2018. Korea’s economic miracle, so called ‘The Miracle on Han River’ is a story of overcoming many hardships by the Korean people that led to the national transformation from poverty to prosperity. As a true friend, Korea would like to share the technological know-how and resources to help Sri Lanka achieve “the Miracle on Kelani River”. I can say that it is the right time for Sri Lanka to change and take a leap to a higher level. Korea is the very country that can assist Sri Lanka to reach the pinnacle of national development and prosperity.

I invite Korean investors to explore opportunities especially in the key sectors including agriculture, renewable energy, infrastructure, LNG, digital economy and so on. There is more potential for the business opportunities to expand between our two countries.

Likewise, what are the best opportunities for SL businesses in Korea?

Import and export relationship is also important as it is two wheels of the same vehicle. Sri Lanka is famous in Korea for rubber, coconut and graphite. Furthermore, apparel products including leather, fabric, and other agricultural items make a significant contribution to the Korean economy. I would also like to mention that Sri Lankan tea is very popular among Koreans for its high quality and distinct taste.

Tourism is also another main aspect; 13,000 Koreans visited Sri Lanka last year. It is only 0.5% of the total tourism in Korea. I am confident that more tourists will arrive in Sri Lanka to enjoy the charm and beauty of the island as Sri Lanka was ranked as the top country to visit by the famous travel guidebook publisher,” Lonely Planet” in 2019.

How are Lankans in Korea contributing to Korea’s well being?

Approximately 23,000 Sri Lankan workers are employed in Korea under the Employment Permit System (EPS). The proactive engagement of the EPS centre has led to the first delegation of migrant workers heading for Korea and it has strengthened the strong bilateral relations of the two countries amid the coronavirus pandemic.

The Republic of Korea is maintaining a strong policy of equal pay for equal work which applies to both Korean nationals and foreign workers including Sri Lankan people. Sri Lankan migrant workers have contributed greatly to uplift both economies. I consider them as civilian diplomats on Korean soil and the Republic of Korea is appreciative of their precious contribution to the Korean economy.

I hope to expand the labour collaboration between our two countries.

S. Korea is one of the most creative countries. What are the keys to her success?

The Republic of Korea witnessed economic growth with the sheer hard work and dedication of its people. With the limited territory and natural resources, Korea has focused on education and investment on people. The strength of world-renowned enterprises such as Samsung, Hyundai and LG also empowered the Korean economy. With the technological advancement, Korea is a major force in several fields including smart devices, automotive, shipbuilding, and heavy industries. However primary industries such as mass agricultural production also contributed to the economic success in Korea.

The Korean cultural renaissance including K-pop and K- dramas have become popular globally and have also contributed to the economy and helped attract more tourists. Korea would like to share the success stories with Sri Lanka as Korea developed with limited resources, limited workforce. As the ambassador to the Republic of Korea, I love Sri Lanka, I love Sri Lankan people. I look forward to closely working with all of you to achieve our common goals. Let’s stay strong together!

- News Advertiesment

See Kapruka’s top selling online shopping categories such as Toys, Grocery, Flowers, Birthday Cakes, Fruits, Chocolates, Clothing and Electronics. Also see Kapruka’s unique online services such as Money Remittence,News, Courier/Delivery, Food Delivery and over 700 top brands. Also get products from Amazon & Ebay via Kapruka Gloabal Shop into Sri Lanka.

Business

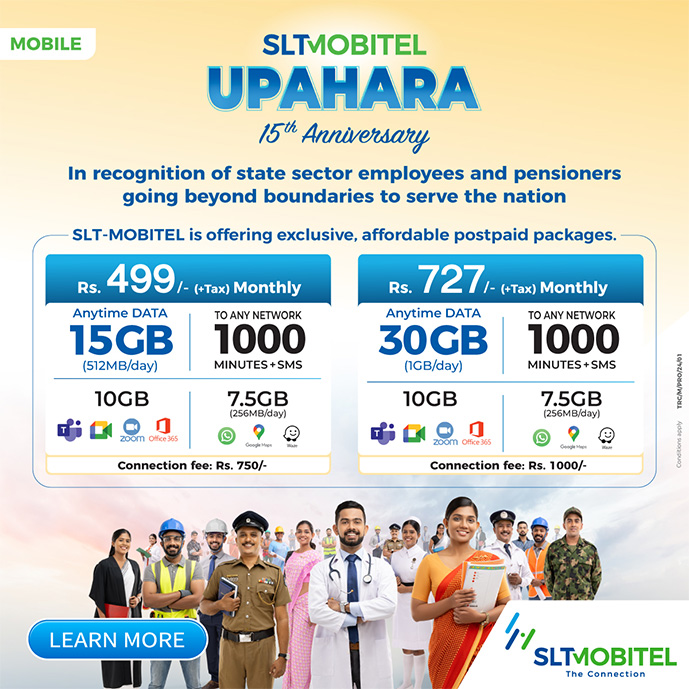

Unlimited music streaming platform in Sri Lanka

SLT-Mobitel, the nation’s ICT and Telecommunications Service Provider recently partnered with Spotify, to mark their launch in Sri Lanka. Spotify is a paid premium music streaming app which allows subscribers to listen to music to their hearts content. Both, SLT-Mobitel Post-Paid and Pre-Paid customers will now be able to enjoy Spotify by activating a monthly recurring subscription or one-time subscription plan and access unlimited music streaming and downloading facilities.

The subscription charges will get added to the user’s customary billing, where payment will be deducted in real time. Starting from the payment date, the user will be able to access Spotify and download their favourite songs, for the next 30 days. Users who sign up for their first monthly subscription will receive an additional one month, courtesy of Spotify. The one-month subscription plan is not applicable with one-time subscription plans. SLT-Mobitel data rates, depending on the user’s respective broadband charges, will apply.

Spotify also has some exciting features that will provide SLT-Mobitel customers with the opportunity to listen to ad-free music, access millions of uninterrupted music under one platform, play any song they like, anywhere they go, and also be able to enjoy their music offline.

SLT-Mobitel customers can select their preferred premium package under four categories; Individual, Duo, Family, Student. Each category has recurring and non-recurring plans. After one month of free streaming, the package will activate once the offer period terminates. While both, the Individual and Student premiums are limited to one account user, the Duo package offers two accounts and the Family premium is accessible through six accounts. To view Spotify plans, users can log on to https://spoti.fi/3aLWvce

Business

Sri Lanka using ‘sovereign power’ over economy: CB Governor

by Sanath Nanayakkare

Anyone conversant with the elements of a political economy would know that Sri Lanka is using its ‘sovereign power’ to manage the different dynamics of the economy in a sustainable manner, Professor W. D Lakshman Governor of the Central Bank said on Wednesday.

“Some critics are saying that we adopt a so-called modern monetary theory. That’s not the case. In fact, Sri Lanka is using its sovereign power in a number of economic aspects to honour its external debt repayment commitments as well as to reduce its debt burden in the medium term as well as achieve resilient growth in the medium to long term, he said.

“We make policy decisions to boost our gross foreign reserves, meet our external debt servicing, to facilitate monetary expansion, to boost our GDP growth, to strengthen our current account balance and manage our domestic and external economic variables in a sustainable manner. This is not a modern monetary theory. This is an age-old tool used by central banks around the world when the circumstances demand it, he said.

“Certain trade-offs will be necessary when dealing with an economy which has a big fiscal gap to bridge. There are efforts to push Sri Lanka towards the IMF again which would in turn have influence on our policymaking. We have taken policy measures to stabilize the economy and we have adequate reserve levels to meet our debt repayments. Meanwhile, we are in negotiations with overseas central banks and multilateral agencies to further boost our reserve level and it would materialise within a matter of weeks,” he noted.

“One of the tools the Central Bank has introduced is in respect of repatriation of export proceeds into Sri Lanka and conversion of such proceeds into Sri Lankan rupees in order to strengthen the foreign exchange situation of the country,” he said.

The Governor made these remarks while delivering the keynote speech at a webinar organised by the Veemansa Initiative led by its Managing Director Luxman Siriwardene – the former Executive Director of Pathfinder Foundation.

The webinar revolved round the topic ‘External debt situation in Sri Lanka: Are we heading for a resolution or crisis?’

Professor Sirimal Abeyratne, Prof. Sumanasiri Liyanage, Dr. Nishan de Mel and Dr. Ravi Liyanage were the other speakers on the panel.

Business

CSE on the rebound; indices close positive

By Hiran H.Senewiratne

CSE produced signs of a rebound yesterday with both indices closing positive, though turnover remained low. Central Bank Governor W.D Lakshman’s recent statement on managing foreign reserves gave some boost to the market yesterday, stock market analysts said.

The index experienced a zigzag movement within the early hours of trading; thereafter, it recorded a slight up-trend as it reached its intraday high of 7,439. Later, the market witnessed a down-trend at mid-day, followed by a sideways movement and closed at 7,372, gaining 43 points during the month of February, market sources said.

It is said the banking sector dominated turnover with a contribution of considerable parcel trades in Sampath Bank, Commercial Bank and HNB.

Further, the Commercial Bank’s impressive quarterly results during the recent turbulent period also built investor confidence. Commercial Bank was able to register a18 percent net interest income when other banks were reporting a decline. Its share price increased by Rs. 3 or 3.5 percent. On the previous day, its shares started trading at Rs. 85 and at the end of the day they moved up to Rs. 88. Due to the positive growth results, the bank announced a Rs. 4.40 dividend per share, plus a Rs. 2 script divergent for every share.

Further, Sampath Bank shares also appreciated in both crossing and retail. In crossings its shares appreciated by Rs. 1.At the end of the day they moved up to Rs. 154.50. In the retail market, its shares moved up by Rs. 2 or 1.3 percent. Previously, its shares fetched Rs. 154 and at the end of yesterday they moved up to Rs. 156.

Amid those developments, both indices moved upwards. The All Share Price Index went up by 104.48 points and S and P SL20 rose by 67.78 points. Turnover stood at Rs. 3 billion with four crossings. Those crossings were reported in Sampath Bank, where 3.9 million shares crossed for Rs. 602.2 million, its share price being Rs. 154.50, HNB 375,000 shares crossed for Rs. 39.4 million, its shares traded at Rs. 105, Pan Asia Power 9.5 million shares crossed for Rs. 33.2 million, its shares traded at Rs. 3.50 and Access Engineering 1.2 million shares crossed for Rs. 28.2 million; its shares traded at Rs. 24.

In the retail market top five companies that mainly contributed to the turnover were, Expolanka Rs. 450 million (10 million shares traded), JKH Rs. 205 million (1.3 million shares traded), Browns Investments Rs. 199 million (34.9 million shares traded), Sampath Bank Rs. 191 million (1.2 million shares traded) and Dipped Products Rs. 137.7 million (2.8 million shares traded). During the day 101 million share volumes changed hands in 18046 transactions.

During the day, Expolanka, the biggest contributor to the turnover, saw its share price appreciating by Rs. 6.20 or 15 percent. Its share price quoted on the previous day was Rs. 41 and at the end of trading yesterday it moved up to Rs. 47.

Sri Lanka’s rupee quoted wider at 193.50/195.50 levels to the US dollar in the spot next market on Thursday while bond yields remained unchanged, dealers said. The rupee last closed in the spot market at 194.50/195.00 to the dollar on Wednesday.