Business

Lakpahana – From our hands to yours for over 48 years

‘Lakpahana’ is a store located in Colombo 07, across from the Colombo Race Course that owes its identity to the ambition of its founder Deshamanya Mrs. Siva Obeyesekere. Starting out as a store depicting rich cultural arts and crafts, it preserves skillfully and elegantly designed handicrafts. Lakpahana has a wide variety of hand made products that are 100% Sri Lankan. It gives the rural Sri Lankan craftsman the opportunity to market their products locally and abroad.

Today with the change in social, trends, handicrafts have taken on a new dimension, they are now not only artifacts of beauty but are utilitarian objects absorbed into modern day living. Most handicrafts use traditional motifs, colours and designs for decoration. The demands for new designs for the existing range of handicrafts and complete new innovations adopting traditional techniques and motifs are constantly increasing. The craftspeople of ‘Lakpahana’ make crafts preserving the aesthetic grace of age old traditional handicrafts and absorb new thoughts and ideas to cater to the modern market. They strike a balance between tradition and modern day trends by combining two or more materials, finding new uses for existing handicrafts and by introducing modern art in the way of colours, motifs and techniques.

Finding new utility value for traditional crafts or by adding value to the existing range these crafts have been transformed into articles for modern day living use.

Recommended by Trip Advisor, a member of the World Craft Council and with many UNESCO Excellence Awards for its crafts, Lakpahana truly is representative of Sri Lanka’s rich craft heritage.

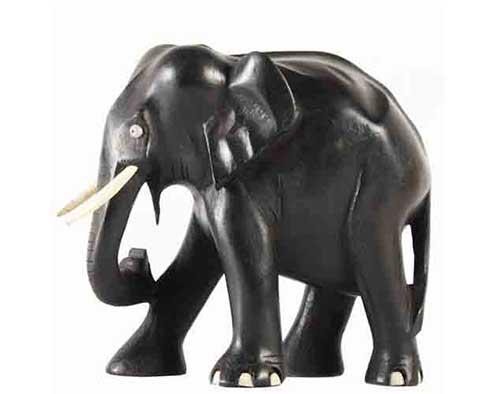

Wooden Items

The wooden containers with decorative lacquer work, which earlier was a thing of ornamentation, has now been converted into an item for packaging tea, coffee, spices and various other items. Traditional lacquer work is an intricate process of painting with the finger nail or thumb nail, it is aptly called ‘niyapothu vada’ (finger nail work) and hails from the Matale district of Hapuvida in South Matale.

In recent times modern, lighter shades are combined with modern form of art. A good example, is the mats made of reed and rush woven with the traditional motifs named ‘Makara’ (a mythical animal), ‘Sinha’ (Lion), ‘Hansa’ (Swan), elephant and lotus used along with the bright colours of red, yellow, black and green as well as conventional stripes and circles.

Dumbara Mats

Dumbara a picturesque & fertile valley is to the north of Kandy at the foot of the ‘Hunnasgiri Hill’ has been the home of traditional ‘Dumbara’ mat weavers who for ages have practiced the art of mat weaving, using hana (hemp). The hana plant (Agave Sisalana) growing wild in the Dumbara valley provides the raw material for mat weaving. In addition to the traditional colourful mats. Dumbara craftsmen also make cushion covers, hand bags, shopping bags, letter and shoe holders, fans, screens, table mats, coasters, file and book covers, purses and other products to meet the demands of contemporary society.

Amongst the wide range of traditional handicrafts are masks, lacquer work, silverware, pewter, silver jewellery, brass work, handloom textiles, lace embroidery items, educational toys, coir rugs and mats, bamboo items, paper pulp and elephant dung items, coconut husk items and hand sewn hankies.

Therefore LAKPAHANA is a store waiting to be discovered especially for these looking for a special memento that has a Sri Lankan identity.

Searching for the most delicious and freshly made traditional treats? Head over to Lakpahana and indulge. Choosing from a variety of items such as stuffed veralu, coconut toffee, kalu dodol, cadju puhul, narang kavum and unduwel. The items are made fresh on a daily basis. Everyday favourites such as murukku, macaroons, marshmallows, aasmi, kokis, kavum and mung kavum are available in addition to neatly wrapped packages of love cake, bibikkan and jaggery cake. Lunu dehi as is a popularly known, is an integral part of Sri Lankan cuisine and even culture. These are just perfect for the festive season or even as a gift. Cake orders can be placed too. Sugar and jaggery alpal, tala bola, coconut and milk toffees stock the shelves in addition to the other yummy treats. Lakpahana also has freshly prepared lamprais for lunch every day. Other items available at Lakpahana include jars of bees’ honey (50ml/100ml), lime pickle, seeni sambol and dried fish pachade.

Lakpahana is open from 9.30 a.m. – 6.30 p.m. Monday to Saturday and 10 a.m. – 6 p.m. on Sundays & Holidays.

- News Advertiesment

See Kapruka’s top selling online shopping categories such as Toys, Grocery, Flowers, Birthday Cakes, Fruits, Chocolates, Clothing and Electronics. Also see Kapruka’s unique online services such as Money Remittence,News, Courier/Delivery, Food Delivery and over 700 top brands. Also get products from Amazon & Ebay via Kapruka Gloabal Shop into Sri Lanka.

Business

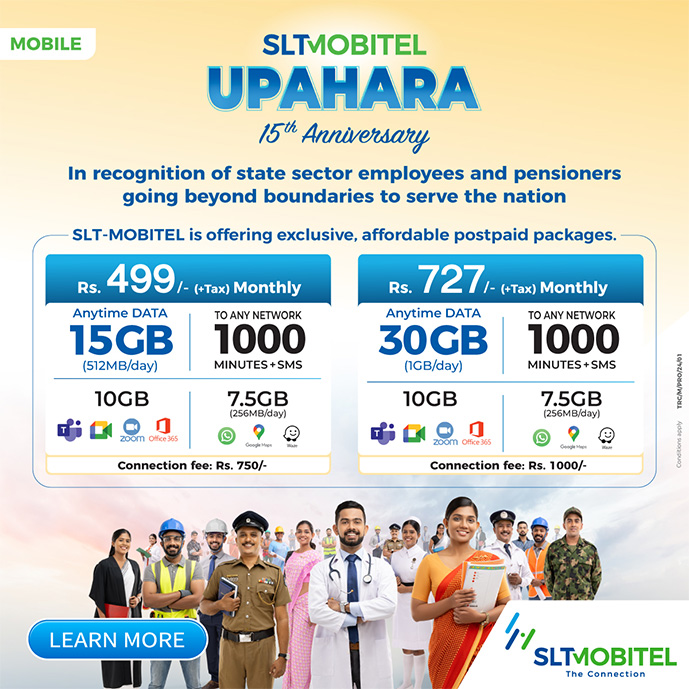

Unlimited music streaming platform in Sri Lanka

SLT-Mobitel, the nation’s ICT and Telecommunications Service Provider recently partnered with Spotify, to mark their launch in Sri Lanka. Spotify is a paid premium music streaming app which allows subscribers to listen to music to their hearts content. Both, SLT-Mobitel Post-Paid and Pre-Paid customers will now be able to enjoy Spotify by activating a monthly recurring subscription or one-time subscription plan and access unlimited music streaming and downloading facilities.

The subscription charges will get added to the user’s customary billing, where payment will be deducted in real time. Starting from the payment date, the user will be able to access Spotify and download their favourite songs, for the next 30 days. Users who sign up for their first monthly subscription will receive an additional one month, courtesy of Spotify. The one-month subscription plan is not applicable with one-time subscription plans. SLT-Mobitel data rates, depending on the user’s respective broadband charges, will apply.

Spotify also has some exciting features that will provide SLT-Mobitel customers with the opportunity to listen to ad-free music, access millions of uninterrupted music under one platform, play any song they like, anywhere they go, and also be able to enjoy their music offline.

SLT-Mobitel customers can select their preferred premium package under four categories; Individual, Duo, Family, Student. Each category has recurring and non-recurring plans. After one month of free streaming, the package will activate once the offer period terminates. While both, the Individual and Student premiums are limited to one account user, the Duo package offers two accounts and the Family premium is accessible through six accounts. To view Spotify plans, users can log on to https://spoti.fi/3aLWvce

Business

Sri Lanka using ‘sovereign power’ over economy: CB Governor

by Sanath Nanayakkare

Anyone conversant with the elements of a political economy would know that Sri Lanka is using its ‘sovereign power’ to manage the different dynamics of the economy in a sustainable manner, Professor W. D Lakshman Governor of the Central Bank said on Wednesday.

“Some critics are saying that we adopt a so-called modern monetary theory. That’s not the case. In fact, Sri Lanka is using its sovereign power in a number of economic aspects to honour its external debt repayment commitments as well as to reduce its debt burden in the medium term as well as achieve resilient growth in the medium to long term, he said.

“We make policy decisions to boost our gross foreign reserves, meet our external debt servicing, to facilitate monetary expansion, to boost our GDP growth, to strengthen our current account balance and manage our domestic and external economic variables in a sustainable manner. This is not a modern monetary theory. This is an age-old tool used by central banks around the world when the circumstances demand it, he said.

“Certain trade-offs will be necessary when dealing with an economy which has a big fiscal gap to bridge. There are efforts to push Sri Lanka towards the IMF again which would in turn have influence on our policymaking. We have taken policy measures to stabilize the economy and we have adequate reserve levels to meet our debt repayments. Meanwhile, we are in negotiations with overseas central banks and multilateral agencies to further boost our reserve level and it would materialise within a matter of weeks,” he noted.

“One of the tools the Central Bank has introduced is in respect of repatriation of export proceeds into Sri Lanka and conversion of such proceeds into Sri Lankan rupees in order to strengthen the foreign exchange situation of the country,” he said.

The Governor made these remarks while delivering the keynote speech at a webinar organised by the Veemansa Initiative led by its Managing Director Luxman Siriwardene – the former Executive Director of Pathfinder Foundation.

The webinar revolved round the topic ‘External debt situation in Sri Lanka: Are we heading for a resolution or crisis?’

Professor Sirimal Abeyratne, Prof. Sumanasiri Liyanage, Dr. Nishan de Mel and Dr. Ravi Liyanage were the other speakers on the panel.

Business

CSE on the rebound; indices close positive

By Hiran H.Senewiratne

CSE produced signs of a rebound yesterday with both indices closing positive, though turnover remained low. Central Bank Governor W.D Lakshman’s recent statement on managing foreign reserves gave some boost to the market yesterday, stock market analysts said.

The index experienced a zigzag movement within the early hours of trading; thereafter, it recorded a slight up-trend as it reached its intraday high of 7,439. Later, the market witnessed a down-trend at mid-day, followed by a sideways movement and closed at 7,372, gaining 43 points during the month of February, market sources said.

It is said the banking sector dominated turnover with a contribution of considerable parcel trades in Sampath Bank, Commercial Bank and HNB.

Further, the Commercial Bank’s impressive quarterly results during the recent turbulent period also built investor confidence. Commercial Bank was able to register a18 percent net interest income when other banks were reporting a decline. Its share price increased by Rs. 3 or 3.5 percent. On the previous day, its shares started trading at Rs. 85 and at the end of the day they moved up to Rs. 88. Due to the positive growth results, the bank announced a Rs. 4.40 dividend per share, plus a Rs. 2 script divergent for every share.

Further, Sampath Bank shares also appreciated in both crossing and retail. In crossings its shares appreciated by Rs. 1.At the end of the day they moved up to Rs. 154.50. In the retail market, its shares moved up by Rs. 2 or 1.3 percent. Previously, its shares fetched Rs. 154 and at the end of yesterday they moved up to Rs. 156.

Amid those developments, both indices moved upwards. The All Share Price Index went up by 104.48 points and S and P SL20 rose by 67.78 points. Turnover stood at Rs. 3 billion with four crossings. Those crossings were reported in Sampath Bank, where 3.9 million shares crossed for Rs. 602.2 million, its share price being Rs. 154.50, HNB 375,000 shares crossed for Rs. 39.4 million, its shares traded at Rs. 105, Pan Asia Power 9.5 million shares crossed for Rs. 33.2 million, its shares traded at Rs. 3.50 and Access Engineering 1.2 million shares crossed for Rs. 28.2 million; its shares traded at Rs. 24.

In the retail market top five companies that mainly contributed to the turnover were, Expolanka Rs. 450 million (10 million shares traded), JKH Rs. 205 million (1.3 million shares traded), Browns Investments Rs. 199 million (34.9 million shares traded), Sampath Bank Rs. 191 million (1.2 million shares traded) and Dipped Products Rs. 137.7 million (2.8 million shares traded). During the day 101 million share volumes changed hands in 18046 transactions.

During the day, Expolanka, the biggest contributor to the turnover, saw its share price appreciating by Rs. 6.20 or 15 percent. Its share price quoted on the previous day was Rs. 41 and at the end of trading yesterday it moved up to Rs. 47.

Sri Lanka’s rupee quoted wider at 193.50/195.50 levels to the US dollar in the spot next market on Thursday while bond yields remained unchanged, dealers said. The rupee last closed in the spot market at 194.50/195.00 to the dollar on Wednesday.