Business

A cut tree, a dead elephant, is a lost tourism dollar in the future

by Michel Nugawela and Pesala Karunaratna

Four decades of inaction since introduction of open economy – Sri Lanka has never missed an opportunity to miss an opportunity

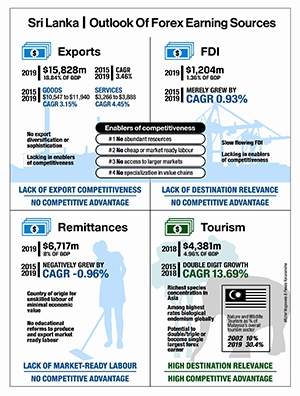

Globally and regionally, country is unplanned and unprepared to drive forex earnings; exports, FDIs, and foreign-earned wage remittances record very slow growth rates below CAGR 5%

With CAGR 13.69%, tourism sector shows resilience despite no concentrated effort or national strategy; emerges as priority sector in medium-term to be No 1 forex earner

Nature and wildlife tourism has most potential to drive Sri Lanka as a hot destination for high value travellers as global mobility returns in 2021

A single elephant, alive, contributes $0.16mn a year or $11mn over its lifetime to tourism sector; 350 elephant deaths in 2019 amount to economic value of $3.9bn had they lived their lives fully

Forest cover reduced by 130,349 hectares from 2010-2019 reflecting a sharp increase of 8.6% of net forest change

The coronavirus crisis throws into sharp relief the tenuous state of Sri Lanka’s economy. The government is committed to export expansion but remains handicapped by decades of unpreparedness in strengthening the underlying enablers of competitiveness.

The coronavirus crisis throws into sharp relief the tenuous state of Sri Lanka’s economy. The government is committed to export expansion but remains handicapped by decades of unpreparedness in strengthening the underlying enablers of competitiveness.

This opinion paper proposes a refocus on tourism as the priority sector to drive growth as Sri Lanka begins the difficult and lengthy task of reforming, restructuring, and strengthening national competitiveness. This will require shifting away from one-size-fits-all marketing under the mass tourism model to developing a product differentiation strategy that targets the best tourists – the high value traveller – with our best assets – nature and wildlife. This broad and diverse segment of travellers outspend mass tourists by 3-4 times and will be the first to travel and visit other countries once global mobility returns in 2021.

However, the high rate of deforestation dismantles the only competitive advantage Sri Lanka has to compete internationally and increase its exports of services. By stripping away nature and wildlife assets, the destination will be left with only its beaches and reputation for cheap sea-sun-sand tourism in the future.

Stagnant exports of goods and services

Exports of goods and services (% of GDP) was reported at 18.8% in 2019 of which goods accounted for 14.2% and services for 4.6%. In the years 2015-2019, total exports of goods grew from $10,547mn to $11,940mn – CAGR 3.15% – while total exports of services increased from $3,266mn to $3,888mn – just CAGR 4.45%.

Sri Lanka continues to lag other emerging economies in Asia that have successfully transitioned from an overreliance on primary goods to achieve export diversification and sophistication. In 1989, our total exports of goods and services as a percentage of GDP was 21.4% against Vietnam’s 16.5%. Thirty years later, our exports had shrunk to 18.8% as Vietnam’s increased to 119.3%. The reasons for this disparity can be found in the underlying enablers of export competitiveness where Sri Lanka’s capabilities are weak or entirely lacking.

Enabler #1 – Resource abundance

We have none. Consider the example of India’s BPO industry which is around 1% of the country’s GDP and 6% share of global BPO, directly and indirectly employing 10mn people. According to Tholons and AT Kearney Indexes of 2019, India remains the leading country to outsource because of cheap labour costs, a huge talent pool of skilled, English-speaking professionals (India’s English proficiency: #35/100 in the world and #5/25 in Asia), and tech-savvy manpower, despite competition from The Philippines, Vietnam and other Asian countries.

Enabler #2 – Price and contribution of unskilled or market-ready labour

We are stagnating at middle-income levels. The unskilled labour market demands higher wages and Sri Lanka lacks a pool of skilled market-ready workers (unlike the example of India, above).

Enabler #3 – Trade agreements that give producers access to a larger market

Domestic interest groups in Sri Lanka have opposed and successfully pressured governments to abandon free trade agreements. Meanwhile, emerging economies like Vietnam have made huge economic advances through trade liberalization and global integration. Since its Doi Moi reforms, the country has signed 12 (mostly bilateral) FTAs that have increased trade by ten-fold – from US$30bn in 2000 to almost US$300bn by 2014 – shifting it away from exports of primary goods and low-tech manufacturing products to more complex high-tech goods like electronics, machinery, vehicles and medical devices. The competitiveness of its exports will continue to increase, firstly, through more diversified input sources from larger trade networks and cheaper imports of intermediate goods from partner countries, and secondly, through partnerships with foreign firms that transfer the know-how and technology that is needed to leap into higher valued-added production.

Enabler #4 – Ability to enter, establish or move up regional or global value chains and production networks

Today, global firms optimize resources by investing or outsourcing the design, procurement, production, or distribution stages of their value chain activities across different countries. Yet since 1978, Sri Lanka has only captured share in the manufacturing and design stages of the global apparel value chain. The examples of Vietnam and Thailand demonstrate how both economies have become integral to different stages of the smartphone and automobile value chains for Samsung and Toyota.

Vietnam:

Vietnam attracted Samsung at the early stages of smartphone evolution. Samsung established its first factory in Vietnam in 2008, when smartphone penetration was 10.8% globally; today it has three factories in Vietnam and world smartphone penetration is at 41%. Samsung remains the single largest foreign investor in Vietnam, with investments totaling $17bn (20% of Sri Lanka’s GDP) whilst Vietnam’s exports of smartphones and spare parts, mostly produced by Samsung Electronics, account for $51.38bn (20% of Vietnam’s GDP). On top of the current $220mn Samsung R&D center, Vietnamese Prime Minister Nguyen Xuan Phuc has requested Samsung Chairman Lee Jae-yong to next invest in a chip manufacturing plant, further strengthening the country’s competitiveness and sophistication in exports.

Thailand:

Toyota’s decision to enter the Thai automobile market in 1962 was largely due to the country’s industrial policy regime. Today – after 6 decades of concentrated effort between the Thai government and Toyota – Thailand is becoming a global passenger car production hub. Toyota’s investments have also helped to transfer knowledge and technology into Thailand, strengthening the R&D capabilities of Thai engineers. Toyota Thailand president Michinobu Sugata has expressed complete confidence in both Thailand and the company’s future direction in the country.

Since 1978, Sri Lanka has repeatedly missed opportunities to enter or establish itself in global value chains and production networks. We continue to be unplanned and unprepared in strengthening the underlying enablers of export competitiveness. Expect meagre export growth to continue.

Slow flowing foreign direct investment

These enablers of competitiveness are also the most important considerations to increase foreign direct investment. Inflows between 2015-2019 totalled $6.4bn, averaging $1.2bn every year and merely growing by CAGR 0.93% (this excludes the 99-year lease of Hambantota port to China in exchange for $1.1bn). Without improving supply-side constraints, international investors will remain reluctant to sink substantial resources in the country.

Strengthening the underlying enablers of competitiveness will take time. Expect stagnation in FDI inflows to continue.

Sluggish foreign worker remittances

Sri Lanka has become a major country of origin for unskilled workers with minimal economic value. Wage receipts, which amounted to $6,717mn in 2019 or 8% of GDP, negatively grew by CAGR -0.96% between the years 2015-2019. In 2019, the highest inflow ($3,459mn) came from the Middle East, a segment that participates in the lowest economic positions and lacks the skills, abilities and qualifications to mitigate any downturn in value in remittance flows.

However, the demographics are changing for neighbouring countries like India, where an increasing number of skilled white-collar workers (a growing cohort of professionals in the IT and engineering fields, according to MoneyGram) are quadrupling the average volume per each remittance.

To export quality human capital and increase our share of foreign-earned wages, Sri Lanka must introduce transformational policy reforms in education. Our university system – supported by proactive primary and secondary education systems – must be restructured to produce market-ready workers with the skills and adaptability to learn, grow and respond to change.

Reforms in the education sector will take time. Improving value in wage receipts remains a remote opportunity in the near future.

Amid no support or concentrated effort, tourism receipts grow double-digit

Tourism continued to expand and record double-digit growth of CAGR 13.69% between the years 2015-2018, despite the absence of a national strategy and a high percentage of low-income visitors. As a single sector, tourism receipts amounted to $4,381mn in 2018 or 4.96% of GDP and trended towards topping that in 2019. As Sri Lanka is weak or entirely lacking in the underlying enablers of competitiveness, and continues to be unplanned and unprepared in all other means of earning foreign exchange, tourism is the priority sector to drive economic growth in the short to medium-term.

The myth of mass tourism

For Sri Lanka, mass tourism has its advantages; it produces high revenues at high seasons by attracting tourists looking for the cheapest way to holiday (Sri Lanka’s largest inbound mass tourist markets are India, Britain, China, Germany, France, Australia, Russia, the US, the Maldives, and Canada). The mass tourism sector is also one of the largest employers in the country, providing direct and indirect employment to about 400,000 people.

But there are inherent constraints to the mass tourism model – such as its high seasonality, low average length of stay and low occupancy rates – which accelerate a downward pressure on prices. By repeatedly discounting for shrinking tourism dollars, mass tourism suppliers attract tourists who don’t spend (enough) and the tourism product stagnates: service quality decreases and consumer dissatisfaction increases over time. Finally, the destination gains popularity and is promoted for inexpensive travel.

- News Advertiesment

See Kapruka’s top selling online shopping categories such as Toys, Grocery, Flowers, Birthday Cakes, Fruits, Chocolates, Clothing and Electronics. Also see Kapruka’s unique online services such as Money Remittence,News, Courier/Delivery, Food Delivery and over 700 top brands. Also get products from Amazon & Ebay via Kapruka Gloabal Shop into Sri Lanka.

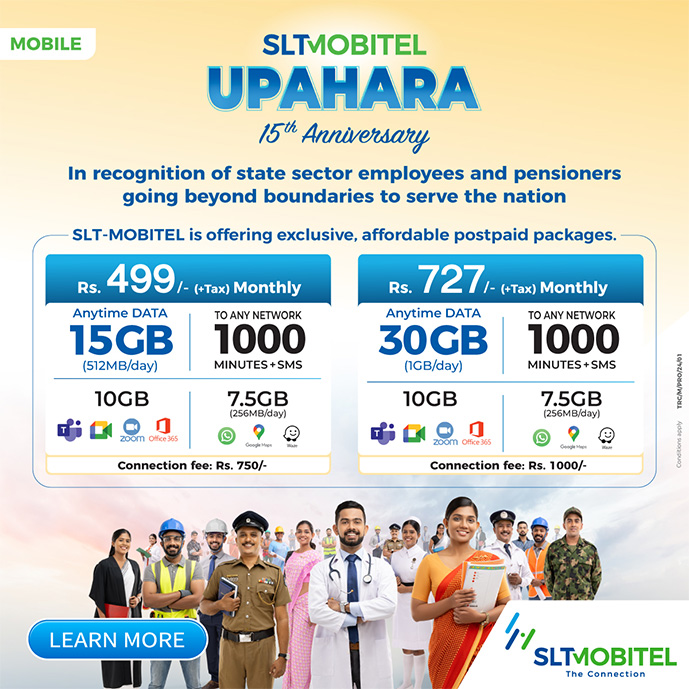

Business

Unlimited music streaming platform in Sri Lanka

SLT-Mobitel, the nation’s ICT and Telecommunications Service Provider recently partnered with Spotify, to mark their launch in Sri Lanka. Spotify is a paid premium music streaming app which allows subscribers to listen to music to their hearts content. Both, SLT-Mobitel Post-Paid and Pre-Paid customers will now be able to enjoy Spotify by activating a monthly recurring subscription or one-time subscription plan and access unlimited music streaming and downloading facilities.

The subscription charges will get added to the user’s customary billing, where payment will be deducted in real time. Starting from the payment date, the user will be able to access Spotify and download their favourite songs, for the next 30 days. Users who sign up for their first monthly subscription will receive an additional one month, courtesy of Spotify. The one-month subscription plan is not applicable with one-time subscription plans. SLT-Mobitel data rates, depending on the user’s respective broadband charges, will apply.

Spotify also has some exciting features that will provide SLT-Mobitel customers with the opportunity to listen to ad-free music, access millions of uninterrupted music under one platform, play any song they like, anywhere they go, and also be able to enjoy their music offline.

SLT-Mobitel customers can select their preferred premium package under four categories; Individual, Duo, Family, Student. Each category has recurring and non-recurring plans. After one month of free streaming, the package will activate once the offer period terminates. While both, the Individual and Student premiums are limited to one account user, the Duo package offers two accounts and the Family premium is accessible through six accounts. To view Spotify plans, users can log on to https://spoti.fi/3aLWvce

Business

Sri Lanka using ‘sovereign power’ over economy: CB Governor

by Sanath Nanayakkare

Anyone conversant with the elements of a political economy would know that Sri Lanka is using its ‘sovereign power’ to manage the different dynamics of the economy in a sustainable manner, Professor W. D Lakshman Governor of the Central Bank said on Wednesday.

“Some critics are saying that we adopt a so-called modern monetary theory. That’s not the case. In fact, Sri Lanka is using its sovereign power in a number of economic aspects to honour its external debt repayment commitments as well as to reduce its debt burden in the medium term as well as achieve resilient growth in the medium to long term, he said.

“We make policy decisions to boost our gross foreign reserves, meet our external debt servicing, to facilitate monetary expansion, to boost our GDP growth, to strengthen our current account balance and manage our domestic and external economic variables in a sustainable manner. This is not a modern monetary theory. This is an age-old tool used by central banks around the world when the circumstances demand it, he said.

“Certain trade-offs will be necessary when dealing with an economy which has a big fiscal gap to bridge. There are efforts to push Sri Lanka towards the IMF again which would in turn have influence on our policymaking. We have taken policy measures to stabilize the economy and we have adequate reserve levels to meet our debt repayments. Meanwhile, we are in negotiations with overseas central banks and multilateral agencies to further boost our reserve level and it would materialise within a matter of weeks,” he noted.

“One of the tools the Central Bank has introduced is in respect of repatriation of export proceeds into Sri Lanka and conversion of such proceeds into Sri Lankan rupees in order to strengthen the foreign exchange situation of the country,” he said.

The Governor made these remarks while delivering the keynote speech at a webinar organised by the Veemansa Initiative led by its Managing Director Luxman Siriwardene – the former Executive Director of Pathfinder Foundation.

The webinar revolved round the topic ‘External debt situation in Sri Lanka: Are we heading for a resolution or crisis?’

Professor Sirimal Abeyratne, Prof. Sumanasiri Liyanage, Dr. Nishan de Mel and Dr. Ravi Liyanage were the other speakers on the panel.

Business

CSE on the rebound; indices close positive

By Hiran H.Senewiratne

CSE produced signs of a rebound yesterday with both indices closing positive, though turnover remained low. Central Bank Governor W.D Lakshman’s recent statement on managing foreign reserves gave some boost to the market yesterday, stock market analysts said.

The index experienced a zigzag movement within the early hours of trading; thereafter, it recorded a slight up-trend as it reached its intraday high of 7,439. Later, the market witnessed a down-trend at mid-day, followed by a sideways movement and closed at 7,372, gaining 43 points during the month of February, market sources said.

It is said the banking sector dominated turnover with a contribution of considerable parcel trades in Sampath Bank, Commercial Bank and HNB.

Further, the Commercial Bank’s impressive quarterly results during the recent turbulent period also built investor confidence. Commercial Bank was able to register a18 percent net interest income when other banks were reporting a decline. Its share price increased by Rs. 3 or 3.5 percent. On the previous day, its shares started trading at Rs. 85 and at the end of the day they moved up to Rs. 88. Due to the positive growth results, the bank announced a Rs. 4.40 dividend per share, plus a Rs. 2 script divergent for every share.

Further, Sampath Bank shares also appreciated in both crossing and retail. In crossings its shares appreciated by Rs. 1.At the end of the day they moved up to Rs. 154.50. In the retail market, its shares moved up by Rs. 2 or 1.3 percent. Previously, its shares fetched Rs. 154 and at the end of yesterday they moved up to Rs. 156.

Amid those developments, both indices moved upwards. The All Share Price Index went up by 104.48 points and S and P SL20 rose by 67.78 points. Turnover stood at Rs. 3 billion with four crossings. Those crossings were reported in Sampath Bank, where 3.9 million shares crossed for Rs. 602.2 million, its share price being Rs. 154.50, HNB 375,000 shares crossed for Rs. 39.4 million, its shares traded at Rs. 105, Pan Asia Power 9.5 million shares crossed for Rs. 33.2 million, its shares traded at Rs. 3.50 and Access Engineering 1.2 million shares crossed for Rs. 28.2 million; its shares traded at Rs. 24.

In the retail market top five companies that mainly contributed to the turnover were, Expolanka Rs. 450 million (10 million shares traded), JKH Rs. 205 million (1.3 million shares traded), Browns Investments Rs. 199 million (34.9 million shares traded), Sampath Bank Rs. 191 million (1.2 million shares traded) and Dipped Products Rs. 137.7 million (2.8 million shares traded). During the day 101 million share volumes changed hands in 18046 transactions.

During the day, Expolanka, the biggest contributor to the turnover, saw its share price appreciating by Rs. 6.20 or 15 percent. Its share price quoted on the previous day was Rs. 41 and at the end of trading yesterday it moved up to Rs. 47.

Sri Lanka’s rupee quoted wider at 193.50/195.50 levels to the US dollar in the spot next market on Thursday while bond yields remained unchanged, dealers said. The rupee last closed in the spot market at 194.50/195.00 to the dollar on Wednesday.