Business

A holistic approach to People Management

Business Oriented People Management by Franklyn Amerasinghe which is to be launched soon, validates that people management is about understanding that the people employed are more than a resource to earn profits and they are as valuable as the investor himself…

by Randima Attygalle

‘Thousands of students are now looking at entering the field of ‘People Management’ and one drawback for them is that usually they study Human Resource Management as part of a curriculum for certification, but they often have no exposure to a holistic analysis of how the ‘People Management’ function is integrated into the functioning of the business.’

The preface to Franklyn Amerasinghe’s latest compilation, ‘Business Oriented People Management’, which is to be launched soon, underlines the fundamental objective the author seeks through his work. The author who alludes to the Human Resource or the HR function as ‘People Management’ further qualifies: “the term ‘Human Resources’ leaves an ugly taste in the mouth. It seems to look at the human element as just another resource like money. People management is about understanding that the people employed are more than a resource to earn profits and they are as valuable as the investor himself.”

The book which deals with the evolution of human resource management, the corporate sector and its rules for governance, people management and performance management, globalization and international obligations, labour legislation, collective bargaining, leadership, dispute management and much more, enables the ‘People Manager’ insights into how decisions are taken and also indicates the benefits for Boards of Companies to have a people-centric focus in their business policies. The sustainability of the corporate and the social aspects of the business are also given attention.

The book, Amerasinghe explains, provides a basic picture of how a private sector organization complies with its multitude of obligations relative to all stakeholders. A publication by the Employers’ Federation of Ceylon (EFC), Business Oriented People Management’ , as its one time Director General/CEO, Amerasinghe notes, is “conceived as a supplementary aid to all those responsible for managing people whether they be designated as HR Personnel or not.”

Amerasinghe who was also a Senior Specialist at the ILO for Employers’ Organizations in East Asia, translates his wealth of experience in his scholarly pursuits. A prolific writer credited for many functional compilations on mediation and cooperation at workplace, conflict management and social dialogue, he has also served on many prestigious Boards and Committees in the public and private sectors.

Amerasinghe who was also a Senior Specialist at the ILO for Employers’ Organizations in East Asia, translates his wealth of experience in his scholarly pursuits. A prolific writer credited for many functional compilations on mediation and cooperation at workplace, conflict management and social dialogue, he has also served on many prestigious Boards and Committees in the public and private sectors.

His latest work provides insights to the executives managing people and how they should fit into the overall achievement of business plans. An unfortunate trend the author notes, is for such executives to look very exclusively at their immediate tasks and targets neglecting the larger picture of the organization. “The fact that each executive contributes to fulfill a corporate plan is sometimes forgotten in pursuit of personal goals. Moreover, many think that following blindly, and without question, policies handed down by higher management is loyalty and is sufficient. Every employee at whatever level should be encouraged to contribute to the development of the company and its policies. Some areas of activity mentioned are for the purpose of identifying the People Manager as vital in the business interests of a private sector organization which is dynamic and looking for sustainable growth,” notes the author adding that the People Manager has two distinct functions: his personal performance and to encourage others with whom he interacts to play their part in corporate performance.

Current management structures, the author observes, reflect that increased responsibility for handling people rests outside the traditional HR Department, although laying down policy and monitoring what is done at departmental level would still remain with it. “Thus the book is meant to assist all managers who participate in managing people,” he says. The advent of digitization and new forms of work arrangements have shifted the ‘circumstances’ of the HR Manager to another level thus changing gears in his/her performance role, says Amerasinghe. “The traditional role of the HR Manager, however, remains the same which is to make the employee contented and motivated to contribute to the organization.”

Paying significant attention to the skills needed on a day to day basis such as dispute handling, negotiation and communication, the book also focuses on industrial relations, an area which the author feels is now quite overlooked, as the HR function looks more and more towards isolating people at work and dealing with them individually. “This does not usually work in the Sri Lankan setting as there is a cultural desire to indulge in collective thinking, especially in rural areas.” The era when production and service centres were in Colombo has been replaced by a policy of moving to rural and suburban centres, with a large number being in Industrial Zones which attract a large number of rural workers.

“The rural worker is conditioned by peer pressure and a strong resistance to change from their traditions. The COVID pandemic which has seen mass loss of jobs especially at lower levels will probably bring back industrial relations to merit more consideration again,” observes the writer.

Amerasinghe’s latest compilation also enables a window to the past in which corporates tackled issues of their employees. Originally the intention was to have an employee who dealt with ‘fire-fighting issues’. The development of HR strategies as a means of keeping employees in line with business requirements was aided by circumstances such as the debacle of the unions in July 1980 and the disillusion which followed. “There has been a remarkable change in the culture of blue collar workers by the movement of collective power to the workplace as opposed to the earlier reality of workers being made to follow the dictates of political parties and their interests,” says Amerasinghe whose latest book balances the advantages of collective agreements against the desire of employers to make employees more focused on their individual terms and earnings which as he says is the key component in the strategy to motivate employees to be more productive.

The COVID situation as the author further observes, brings out a new dimension, which is the futility of legislation to guarantee terms and conditions of employment in the face of employers not having the capacity to meet their legal obligations “The law cannot force employees to stand up for their rights when confronted by a situation when they must either accept what is offered or starve.” The book deals with the legal situation and the need for employers to think of their social responsibility towards employees. “Moreover, in the long term they may have look for new employees when they need to think of ramping up their production or services again.”

The author in his work refers to the Personnel Managers of the past who grew into managing people by long association with the organization. “The more experience one has at the lowest levels of an organization, the more effective one could be. HR personnel should have compulsory internships. Through my book I try to focus on the need to fully comprehend what the organization is about and its responsibility which in turn devolves on the management.” He also goes onto note that there is an onus placed on the management to afford opportunities for the HR personnel to constantly upgrade themselves and be innovative.

- News Advertiesment

See Kapruka’s top selling online shopping categories such as Toys, Grocery, Flowers, Birthday Cakes, Fruits, Chocolates, Clothing and Electronics. Also see Kapruka’s unique online services such as Money Remittence,News, Courier/Delivery, Food Delivery and over 700 top brands. Also get products from Amazon & Ebay via Kapruka Gloabal Shop into Sri Lanka.

Business

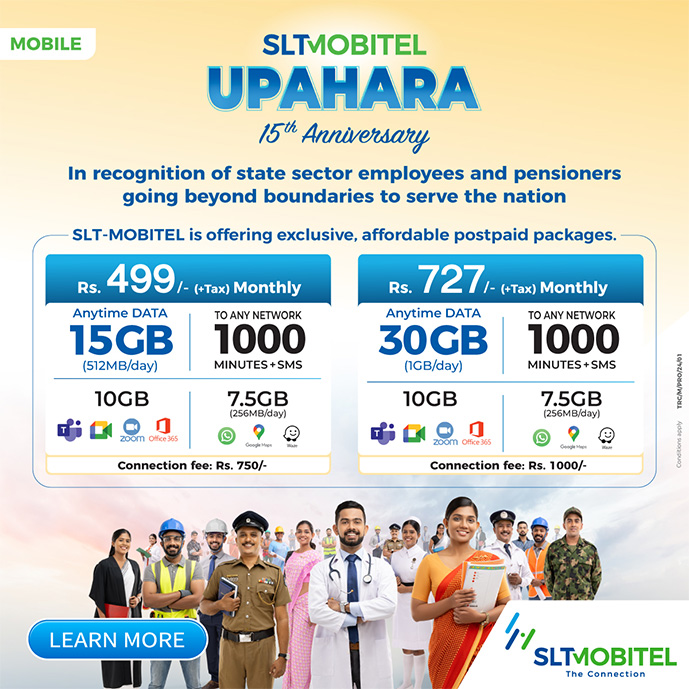

Unlimited music streaming platform in Sri Lanka

SLT-Mobitel, the nation’s ICT and Telecommunications Service Provider recently partnered with Spotify, to mark their launch in Sri Lanka. Spotify is a paid premium music streaming app which allows subscribers to listen to music to their hearts content. Both, SLT-Mobitel Post-Paid and Pre-Paid customers will now be able to enjoy Spotify by activating a monthly recurring subscription or one-time subscription plan and access unlimited music streaming and downloading facilities.

The subscription charges will get added to the user’s customary billing, where payment will be deducted in real time. Starting from the payment date, the user will be able to access Spotify and download their favourite songs, for the next 30 days. Users who sign up for their first monthly subscription will receive an additional one month, courtesy of Spotify. The one-month subscription plan is not applicable with one-time subscription plans. SLT-Mobitel data rates, depending on the user’s respective broadband charges, will apply.

Spotify also has some exciting features that will provide SLT-Mobitel customers with the opportunity to listen to ad-free music, access millions of uninterrupted music under one platform, play any song they like, anywhere they go, and also be able to enjoy their music offline.

SLT-Mobitel customers can select their preferred premium package under four categories; Individual, Duo, Family, Student. Each category has recurring and non-recurring plans. After one month of free streaming, the package will activate once the offer period terminates. While both, the Individual and Student premiums are limited to one account user, the Duo package offers two accounts and the Family premium is accessible through six accounts. To view Spotify plans, users can log on to https://spoti.fi/3aLWvce

Business

Sri Lanka using ‘sovereign power’ over economy: CB Governor

by Sanath Nanayakkare

Anyone conversant with the elements of a political economy would know that Sri Lanka is using its ‘sovereign power’ to manage the different dynamics of the economy in a sustainable manner, Professor W. D Lakshman Governor of the Central Bank said on Wednesday.

“Some critics are saying that we adopt a so-called modern monetary theory. That’s not the case. In fact, Sri Lanka is using its sovereign power in a number of economic aspects to honour its external debt repayment commitments as well as to reduce its debt burden in the medium term as well as achieve resilient growth in the medium to long term, he said.

“We make policy decisions to boost our gross foreign reserves, meet our external debt servicing, to facilitate monetary expansion, to boost our GDP growth, to strengthen our current account balance and manage our domestic and external economic variables in a sustainable manner. This is not a modern monetary theory. This is an age-old tool used by central banks around the world when the circumstances demand it, he said.

“Certain trade-offs will be necessary when dealing with an economy which has a big fiscal gap to bridge. There are efforts to push Sri Lanka towards the IMF again which would in turn have influence on our policymaking. We have taken policy measures to stabilize the economy and we have adequate reserve levels to meet our debt repayments. Meanwhile, we are in negotiations with overseas central banks and multilateral agencies to further boost our reserve level and it would materialise within a matter of weeks,” he noted.

“One of the tools the Central Bank has introduced is in respect of repatriation of export proceeds into Sri Lanka and conversion of such proceeds into Sri Lankan rupees in order to strengthen the foreign exchange situation of the country,” he said.

The Governor made these remarks while delivering the keynote speech at a webinar organised by the Veemansa Initiative led by its Managing Director Luxman Siriwardene – the former Executive Director of Pathfinder Foundation.

The webinar revolved round the topic ‘External debt situation in Sri Lanka: Are we heading for a resolution or crisis?’

Professor Sirimal Abeyratne, Prof. Sumanasiri Liyanage, Dr. Nishan de Mel and Dr. Ravi Liyanage were the other speakers on the panel.

Business

CSE on the rebound; indices close positive

By Hiran H.Senewiratne

CSE produced signs of a rebound yesterday with both indices closing positive, though turnover remained low. Central Bank Governor W.D Lakshman’s recent statement on managing foreign reserves gave some boost to the market yesterday, stock market analysts said.

The index experienced a zigzag movement within the early hours of trading; thereafter, it recorded a slight up-trend as it reached its intraday high of 7,439. Later, the market witnessed a down-trend at mid-day, followed by a sideways movement and closed at 7,372, gaining 43 points during the month of February, market sources said.

It is said the banking sector dominated turnover with a contribution of considerable parcel trades in Sampath Bank, Commercial Bank and HNB.

Further, the Commercial Bank’s impressive quarterly results during the recent turbulent period also built investor confidence. Commercial Bank was able to register a18 percent net interest income when other banks were reporting a decline. Its share price increased by Rs. 3 or 3.5 percent. On the previous day, its shares started trading at Rs. 85 and at the end of the day they moved up to Rs. 88. Due to the positive growth results, the bank announced a Rs. 4.40 dividend per share, plus a Rs. 2 script divergent for every share.

Further, Sampath Bank shares also appreciated in both crossing and retail. In crossings its shares appreciated by Rs. 1.At the end of the day they moved up to Rs. 154.50. In the retail market, its shares moved up by Rs. 2 or 1.3 percent. Previously, its shares fetched Rs. 154 and at the end of yesterday they moved up to Rs. 156.

Amid those developments, both indices moved upwards. The All Share Price Index went up by 104.48 points and S and P SL20 rose by 67.78 points. Turnover stood at Rs. 3 billion with four crossings. Those crossings were reported in Sampath Bank, where 3.9 million shares crossed for Rs. 602.2 million, its share price being Rs. 154.50, HNB 375,000 shares crossed for Rs. 39.4 million, its shares traded at Rs. 105, Pan Asia Power 9.5 million shares crossed for Rs. 33.2 million, its shares traded at Rs. 3.50 and Access Engineering 1.2 million shares crossed for Rs. 28.2 million; its shares traded at Rs. 24.

In the retail market top five companies that mainly contributed to the turnover were, Expolanka Rs. 450 million (10 million shares traded), JKH Rs. 205 million (1.3 million shares traded), Browns Investments Rs. 199 million (34.9 million shares traded), Sampath Bank Rs. 191 million (1.2 million shares traded) and Dipped Products Rs. 137.7 million (2.8 million shares traded). During the day 101 million share volumes changed hands in 18046 transactions.

During the day, Expolanka, the biggest contributor to the turnover, saw its share price appreciating by Rs. 6.20 or 15 percent. Its share price quoted on the previous day was Rs. 41 and at the end of trading yesterday it moved up to Rs. 47.

Sri Lanka’s rupee quoted wider at 193.50/195.50 levels to the US dollar in the spot next market on Thursday while bond yields remained unchanged, dealers said. The rupee last closed in the spot market at 194.50/195.00 to the dollar on Wednesday.