Business

COVID-19 crisis could set-back a generation of women in business

Women across the world have been disproportionally impacted by the COVID-19 pandemic – a staggering 87% of women business owners say they have been adversely affected. Overrepresentation in sectors hardest hit by the economic downturn (tourism, retail, F&B, etc), the pronounced digital gender gap in an increasingly virtual world, and the mounting pressures of childcare responsibilities are only a few factors that have left women particularly vulnerable.

In tackling this stark disparity and unlocking the fullest potential of women in business, the Mastercard Index of Women Entrepreneurs (MIWE) 2020 report findings make a compelling case for building on targeted gender-specific policy best practices internationally.

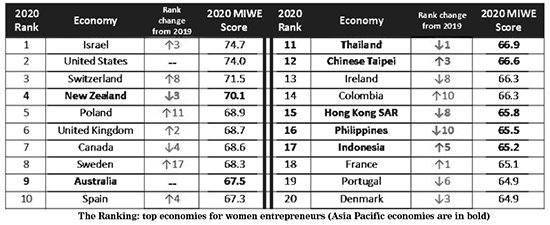

Now in its fourth year, MIWE highlights the vast socio-economic contributions of women entrepreneurs across the world, as well as providing insight on the factors driving and inhibiting their advancement. Through a unique methodology – drawing on publicly available data from leading international organizations, such as the OECD and International Labor Organization – MIWE 2020 includes a global ranking on the advancement of women in business in pre-pandemic conditions across 58 economies (including 15 in the Asia Pacific region), representing almost 80% of the female labor force.

MIWE 2020’s top performing economy is a prime example of gender-specific support mechanisms having swift and significant results. For the first time, Israel tops the MIWE as best economy for women entrepreneurs worldwide, advancing from 4th place in 2019. With an ambition to double the number of female entrepreneurs within two years, Israel’s success has been driven by a focused institutional backing for SMEs – its ‘Support for SMEs’ ranking catapulted from 42nd place in 2019, to 1st in 2020.

Last year’s strong performers, the United States and New Zealand – although dropping from 1st to 2nd,and 2nd to 4th places respectively – demonstrate that economies with mature gender focused initiatives still out-perform on the global stage through continued focus on advancing conditions for women in business. In both these economies, favorable cultural perceptions of entrepreneurism, the high visibility of female leaders that serve as role models for aspiring entrepreneurs, and supportive entrepreneurial conditions play a crucial role in their success.

It is noteworthy that the majority of economies (34 out of a total of 58 in this report) have healthy MIWE scores of 60 to 70 such as Australia, Indonesia, Mainland China, Singapore, Vietnam and Malaysia while 13 economies have lower scores of 50 to 60 such as Japan and India.

Of the 58 markets included in the Index, 12 moved up by five or more ranks year-on-year, while 10 fell by five or more. Asia Pacific’s fast-rising markets include Mainland China (+6) and Indonesia (+5) while the largest drops were seen in Singapore (-12), Philippines (-10), Hong Kong SAR (-8) and Vietnam (-7).

“What the findings make clear is that regardless of an economy’s wealth, level of development, size, and geographic location, gender inequalities continue to persist – even pre-pandemic. What COVID-19 did is that it exacerbated an already problematic situation. It disproportionately disrupted women’s lives and livelihoods to a greater extent than men due to a few pre-existing factors: the jobs and sectors women tend to work in, childcare and domestic responsibilities and the pre-existing gender disparity in business.

Yet, through the pandemic we’ve seen women’s strength and endurance in the face of adversity. If anything, this year has illuminated how vast women’s potential really is. But this moment in time is fragile unless governments, financial services and business organizations come together to do three things: offer systemic support and programs to enable women to survive and thrive in this new normal, equip them with skills to navigate the digital world, and nurture an equitable, accessible financial services system that supports women’s work and entrepreneurship. These are not easy to deliver, but investments like these can yield priceless dividends for not only women, but society as a whole,” said Julienne Loh, Executive Vice President, Enterprise Partnerships, Asia Pacific, Mastercard.

COVID-19 has posed setbacks, but also opportunity

MIWE 2020 also provides initial analysis on the ramifications of COVID-19 on women at work, and draws out effective support policies. Although differing from economy to economy, those proving most effective include expansive relief measures for SMEs – from wage subsidies to furlough schemes and fiscal bailouts – as well as state childcare support.

Crucially, the report presents an optimistic outlook for the future of women entrepreneurs. It indicates that the pandemic could prove a catalyst for exponential progress for women in business and an opportunity to course-correct gender bias. It draws on several points to illustrate this, notably:

• The COVID-19 era presents an empowering narrative for women in leadership, providing inspiration at a time when cultural barriers and fear of failure still impede some women from business ventures. COVID-19 has highlighted women’s ability to lead under extraordinary circumstances. Female world leaders such as Prime Minister Jacinda Ardern of New Zealand, Chancellor Angela Merkel of Germany and the leadership of Chinese Taipei Dr. Tsai Ing-Wen have presided over some of the most successful efforts in containing COVID-19 while instilling order, assurance, trust and calm. With almost half (47.8%) of female entrepreneurs reporting being driven by a desire to contribute to the greater societal good, the impact these leaders have cannot be underestimated.

• Women in business are already demonstrating marked adaptability, despite extensive barriers to success. On the frontline, women business owners are adapting to the new world of work with renewed confidence. 42% have shifted to a digital business model and 34% have identified new business opportunities since the pandemic.

• The ‘next normal’ presents a once-in a-lifetime opportunity to remove existing barriers, driving greater gender participation and parity for women in business. As well as magnifying several fold the many disparities women in business face – from the digital gender gap to financial inclusion – COVID-19 has been an intense stimulus for structural progress.

The report notes that implications of these observations are profound. It further demonstrates the untapped value of women as leaders and, critically, highlights the role of the pandemic in expediating progressive solutions. Leveraging this momentum and championing gender-specific initiatives will be critical to realizing women’s potential and winding down the $172 trillion lost globally (World Bank) due to the differences in lifetime earnings between women and men.

Mastercard’s commitment to driving forward inclusion

Sue Kelsey, Executive Vice President, Global Consumer Products and Financial Inclusion, Mastercard said: “A crisis will always reveal vulnerabilities in the system, and COVID-19 has done that in spades. We have seen the staggering extent of the disparity women in business face. But unlike any other economic downturn, COVID-19 has also paved the way for considerable progress and we have seen what can be achieved when priority is given.”

The MIWE report is just one component in Mastercard’s broader mission to drive forward the advancement of the disconnected and disadvantaged, with a particular commitment to support and help advance female entrepreneurs and small businesses through initiatives such as its Start Path and Path to Priceless programs. In 2020, Mastercard expanded its worldwide financial inclusion commitment, pledging to bring a total of one billion people and 50 million micro and small businesses into the digital economy by 2025. As part of this effort, there will be a direct focus on providing 25 million women entrepreneurs with solutions that can help them grow their businesses, through a range of initiatives crossing funding, mentoring and the development of inclusive technologies.

• Download the MIWE 2020 report and supporting assets here.

• View case studies for New Zealand (p23), South Korea (p33) and Indonesia (p51) in Appendix 1

• Learn more about Mastercard’s efforts to engage, enable and empower women here.

Methodology

MIWE provides world-leading analysis on how women in business are progressing across 58 global economies. Representing almost 80 percent of the international female labour force, the MIWE provides deep-dive analysis on the socioeconomic factors propelling and inhibiting their success.

Through a unique methodology – involving detailed analysis across 12 indicators and 25 sub-indicators spanning Advancement Outcomes, Knowledge Assets & Financial Access, and Supporting Entrepreneurial Conditions – the index ranks 58 economies according to performance over the past year. Aggregating these scores, the index is able to provide an overall grading of how successful individual economies are in advancing female entrepreneurialism in comparison to peers in pre-COVID19 conditions.

This year’s report also provides additional analysis on the early ramifications of emergency measures implemented by governments and business for women entrepreneurs in response to the COVID-19 pandemic across 40 global economies.

The MIWE findings provide clarity and understanding for governments, policymakers, stakeholders, businesses and individuals alike wishing to understand the crucial role of women in business and apply learnings from global economies.

– The End –

About Mastercard (NYSE: MA), www.mastercard.comMastercard is a global technology company in the payments industry. Our mission is to connect and power an inclusive, digital economy that benefits everyone, everywhere by making transactions safe, simple, smart and accessible. Using secure data and networks, partnerships and passion, our innovations and solutions help individuals, financial institutions, governments and businesses realize their greatest potential. Our decency quotient, or DQ, drives our culture and everything we do inside and outside of our company. With connections across more than 210 countries and territories, we are building a sustainable world that unlocks priceless possibilities for all.

Mastercard Communications ContactSarah Guldin, +65 6390 6199

sarah.guldin@mastercard.com

- News Advertiesment

See Kapruka’s top selling online shopping categories such as Toys, Grocery, Flowers, Birthday Cakes, Fruits, Chocolates, Clothing and Electronics. Also see Kapruka’s unique online services such as Money Remittence,News, Courier/Delivery, Food Delivery and over 700 top brands. Also get products from Amazon & Ebay via Kapruka Gloabal Shop into Sri Lanka.

Business

Unlimited music streaming platform in Sri Lanka

SLT-Mobitel, the nation’s ICT and Telecommunications Service Provider recently partnered with Spotify, to mark their launch in Sri Lanka. Spotify is a paid premium music streaming app which allows subscribers to listen to music to their hearts content. Both, SLT-Mobitel Post-Paid and Pre-Paid customers will now be able to enjoy Spotify by activating a monthly recurring subscription or one-time subscription plan and access unlimited music streaming and downloading facilities.

The subscription charges will get added to the user’s customary billing, where payment will be deducted in real time. Starting from the payment date, the user will be able to access Spotify and download their favourite songs, for the next 30 days. Users who sign up for their first monthly subscription will receive an additional one month, courtesy of Spotify. The one-month subscription plan is not applicable with one-time subscription plans. SLT-Mobitel data rates, depending on the user’s respective broadband charges, will apply.

Spotify also has some exciting features that will provide SLT-Mobitel customers with the opportunity to listen to ad-free music, access millions of uninterrupted music under one platform, play any song they like, anywhere they go, and also be able to enjoy their music offline.

SLT-Mobitel customers can select their preferred premium package under four categories; Individual, Duo, Family, Student. Each category has recurring and non-recurring plans. After one month of free streaming, the package will activate once the offer period terminates. While both, the Individual and Student premiums are limited to one account user, the Duo package offers two accounts and the Family premium is accessible through six accounts. To view Spotify plans, users can log on to https://spoti.fi/3aLWvce

Business

Sri Lanka using ‘sovereign power’ over economy: CB Governor

by Sanath Nanayakkare

Anyone conversant with the elements of a political economy would know that Sri Lanka is using its ‘sovereign power’ to manage the different dynamics of the economy in a sustainable manner, Professor W. D Lakshman Governor of the Central Bank said on Wednesday.

“Some critics are saying that we adopt a so-called modern monetary theory. That’s not the case. In fact, Sri Lanka is using its sovereign power in a number of economic aspects to honour its external debt repayment commitments as well as to reduce its debt burden in the medium term as well as achieve resilient growth in the medium to long term, he said.

“We make policy decisions to boost our gross foreign reserves, meet our external debt servicing, to facilitate monetary expansion, to boost our GDP growth, to strengthen our current account balance and manage our domestic and external economic variables in a sustainable manner. This is not a modern monetary theory. This is an age-old tool used by central banks around the world when the circumstances demand it, he said.

“Certain trade-offs will be necessary when dealing with an economy which has a big fiscal gap to bridge. There are efforts to push Sri Lanka towards the IMF again which would in turn have influence on our policymaking. We have taken policy measures to stabilize the economy and we have adequate reserve levels to meet our debt repayments. Meanwhile, we are in negotiations with overseas central banks and multilateral agencies to further boost our reserve level and it would materialise within a matter of weeks,” he noted.

“One of the tools the Central Bank has introduced is in respect of repatriation of export proceeds into Sri Lanka and conversion of such proceeds into Sri Lankan rupees in order to strengthen the foreign exchange situation of the country,” he said.

The Governor made these remarks while delivering the keynote speech at a webinar organised by the Veemansa Initiative led by its Managing Director Luxman Siriwardene – the former Executive Director of Pathfinder Foundation.

The webinar revolved round the topic ‘External debt situation in Sri Lanka: Are we heading for a resolution or crisis?’

Professor Sirimal Abeyratne, Prof. Sumanasiri Liyanage, Dr. Nishan de Mel and Dr. Ravi Liyanage were the other speakers on the panel.

Business

CSE on the rebound; indices close positive

By Hiran H.Senewiratne

CSE produced signs of a rebound yesterday with both indices closing positive, though turnover remained low. Central Bank Governor W.D Lakshman’s recent statement on managing foreign reserves gave some boost to the market yesterday, stock market analysts said.

The index experienced a zigzag movement within the early hours of trading; thereafter, it recorded a slight up-trend as it reached its intraday high of 7,439. Later, the market witnessed a down-trend at mid-day, followed by a sideways movement and closed at 7,372, gaining 43 points during the month of February, market sources said.

It is said the banking sector dominated turnover with a contribution of considerable parcel trades in Sampath Bank, Commercial Bank and HNB.

Further, the Commercial Bank’s impressive quarterly results during the recent turbulent period also built investor confidence. Commercial Bank was able to register a18 percent net interest income when other banks were reporting a decline. Its share price increased by Rs. 3 or 3.5 percent. On the previous day, its shares started trading at Rs. 85 and at the end of the day they moved up to Rs. 88. Due to the positive growth results, the bank announced a Rs. 4.40 dividend per share, plus a Rs. 2 script divergent for every share.

Further, Sampath Bank shares also appreciated in both crossing and retail. In crossings its shares appreciated by Rs. 1.At the end of the day they moved up to Rs. 154.50. In the retail market, its shares moved up by Rs. 2 or 1.3 percent. Previously, its shares fetched Rs. 154 and at the end of yesterday they moved up to Rs. 156.

Amid those developments, both indices moved upwards. The All Share Price Index went up by 104.48 points and S and P SL20 rose by 67.78 points. Turnover stood at Rs. 3 billion with four crossings. Those crossings were reported in Sampath Bank, where 3.9 million shares crossed for Rs. 602.2 million, its share price being Rs. 154.50, HNB 375,000 shares crossed for Rs. 39.4 million, its shares traded at Rs. 105, Pan Asia Power 9.5 million shares crossed for Rs. 33.2 million, its shares traded at Rs. 3.50 and Access Engineering 1.2 million shares crossed for Rs. 28.2 million; its shares traded at Rs. 24.

In the retail market top five companies that mainly contributed to the turnover were, Expolanka Rs. 450 million (10 million shares traded), JKH Rs. 205 million (1.3 million shares traded), Browns Investments Rs. 199 million (34.9 million shares traded), Sampath Bank Rs. 191 million (1.2 million shares traded) and Dipped Products Rs. 137.7 million (2.8 million shares traded). During the day 101 million share volumes changed hands in 18046 transactions.

During the day, Expolanka, the biggest contributor to the turnover, saw its share price appreciating by Rs. 6.20 or 15 percent. Its share price quoted on the previous day was Rs. 41 and at the end of trading yesterday it moved up to Rs. 47.

Sri Lanka’s rupee quoted wider at 193.50/195.50 levels to the US dollar in the spot next market on Thursday while bond yields remained unchanged, dealers said. The rupee last closed in the spot market at 194.50/195.00 to the dollar on Wednesday.