Business

COVID 19 and diabetes: a lethal partnership? How do we overcome this?

By Dr. Kayathri Periasamy

With the latest wave of COVID-19 infections sweeping steadily across Sri Lanka, attention has been directed towards persons with uncontrolled, pre-existing conditions, particularly diabetes; as a sect most vulnerable to get severely ill or die because of complications caused by the virus. This has shed light on another growing concern among healthcare providers and patients, which is that patients suffering from diabetes or other chronic conditions are finding it increasingly difficult or are unable to access the medical care they require due to mandatory albeit essential curfew measures combined with a deep fear of contracting the virus in communal healthcare settings.

With a staggering 463 million adult diabetic patients present worldwide, World Diabetes Day 2020 – falling on the 14th of November- is a critical time for diabetes support communities and healthcare advocates to rally together to create awareness about this debilitating medical condition and push for progress in the standards of care and the better management of diabetic patients during a pandemic. In Sri Lanka alone, 1 in 10 adults are approximated to suffer from the disease. It is also then vital to look at ways to help stop more people from getting this disease, particularly at a time when ‘lockdown’ lifestyles are more often than not likely to be sedentary, unhealthy and stressful; an ideal background for a diabetes diagnosis.

Why is uncontrolled diabetes such a potent accelerant for COVID-19?

A recent study conducted by Lancet on Diabetes & Endocrinology screened over 61 million medical records in the U.K. to find that 30% of COVID-19 deaths can be attributed to people with diabetes. After accounting for factors such as demography and chronic medical conditions, the risk of succumbing to the virus was shown to be about three times higher for people with Type 1 diabetes and almost twice as high for Type 2, versus those without the disease.

There appears to be two primary reasons driving this predicament. Over a lifetime, poor glucose control inflicts widespread damage in our systems which can lead to strokes, heart attacks, kidney failure, eye disease, and limb amputations. The linings of blood vessels throughout the body weaken to an extent where they can’t ferry necessary nutrients adequately. Inflammation is another byproduct of poor diabetes control, which makes the body ill-prepared for the onslaught of the viral disease. Secondly, the rich environment of elevated blood glucose present in diabetic patients, makes them prone to superadded bacterial complications during the viral infection. Many diabetics also tend to have other co-morbidities such as obesity, hypertension, and heart disease, which are all factors that aggravate complications during viral illneses. These problems are seen in any infections in the setting of diabetes and not only with COVID 19. The pandemic has just highlighted the difficulties of having diabetes

What precautions can diabetic patients take?

So during this pandemic, apart from strict adherence to general COVID-19 personal safety protocols such as strict social distancing and sanitization, it is important for patients to regularly monitor their glucose levels to avoid complications caused by fluctuating blood glucose. Proper hydration is essential for good health. It is also crucial to have access to a good supply of the prescribed diabetes medications and healthy food so that patients are able to correct the situation if blood glucose levels fluctuate. Finally, sticking to a comfortable daily routine, maintaining an exercise program even within the confines of your home, reducing excessive work and having a good night’s sleep can go a long way in keeping you strong. In essence, maintaining good blood sugar levels may be their best defense against severe COVID-19.

Disruption to continuity of care for diabetes patients

A rapid assessment survey conducted by WHO among Ministries of Health across many countries, focusing on the service delivery for NCDs during the COVID-19 pandemic, revealed deepening concerns that many people living with NCDs are no longer receiving appropriate treatment or access to medicines during the COVID-19 pandemic. The more severe the transmission phase of the COVID-19 pandemic, the more NCD care services were disrupted.

With our country currently in the cluster transmission phase and heading towards the community transmission phase due to the large and distant spread of the first-line contacts, the threat to NCD care and especially routine and emergency care of diabetes patients worries us physicians. As healthcare providers, we too are torn between the dilemma of not wanting to expose our patients to unnecessary hospital visits and the need to ensure that all our patients have continued access to their healthcare team along with a steady supply of medicines and other diabetes care products such as glucometer strips and insulin. Unfortunately, the delay in visiting their healthcare provider when they have symptoms of complications has caused many people to present late to the hospital with heart attacks or infections. A delayed presentation, weakens the patient further.

This disruption to healthcare services is foreseen to be a huge dilemma for patients and healthcare providers alike, especially when it comes to the care of patients with diabetes and other non-communicable diseases. In Sri Lanka, the Ministry of Health, is currently providing a number of telemedicine services and has opened avenues to deliver medicines to houses without diabetic persons having to visit crowded settings

How do we counter this?

At Healthy Life Clinic, we adhere strictly to COVID-19 safety operational health protocols established according to Ministry of Health (MOH), Epidemiology Unit. All incoming patients are screened by our nurses as soon as appointments are made over the phone, to understand the nature of their illness. If there is a worry that they could have contracted COVID-19 or have been in contact with such patients, they are given the opportunity to speak to the doctor first over the phone for a detailed history. Every patient will be consulted and no one is turned away from our care.

In order to help patients overcome barriers such as curfews or even the fear of entering communal healthcare settings, our experienced, highly-regarded team of consultants conducts telehealth consultations via established, trusted telemedicine partners such as oDoc and Mydoctor.lk to maintain continuity of care throughout this pandemic. We have also moved many of our long-standing diabetes care and weight management programs online, which have proven to be effective even in the absence of a physical meeting and examination. Additionally, our social media platforms and website are constantly updated to increase awareness about this condition, along with content that informs people about the proper management and prevention of diabetes – particularly when it is thus connected to COVID-19.

(Dr. Kayathri Periasamy is a consultant physician MBBS (UK), MRCP (UK), Board Certified in Int. Medicine (U.S.A). She is the founder of Healthy Life Clinic, Colombo 07.)

- News Advertiesment

See Kapruka’s top selling online shopping categories such as Toys, Grocery, Flowers, Birthday Cakes, Fruits, Chocolates, Clothing and Electronics. Also see Kapruka’s unique online services such as Money Remittence,News, Courier/Delivery, Food Delivery and over 700 top brands. Also get products from Amazon & Ebay via Kapruka Gloabal Shop into Sri Lanka.

Business

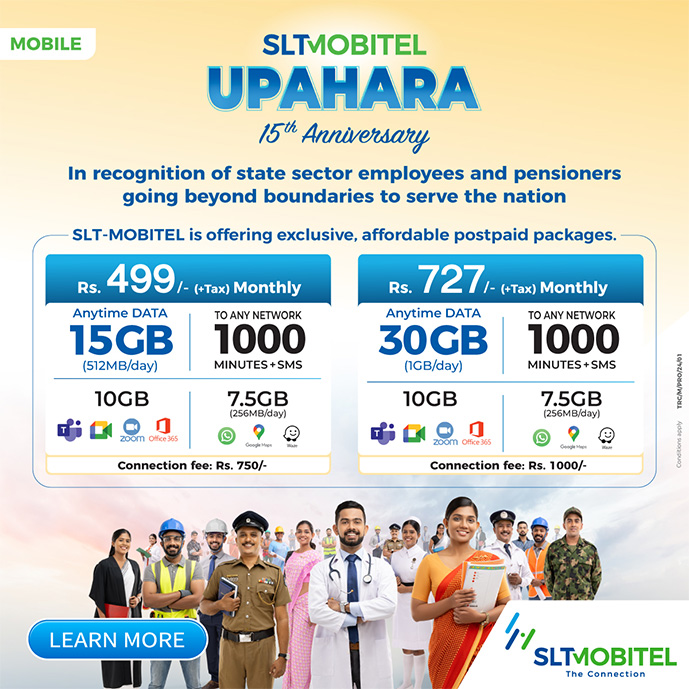

Unlimited music streaming platform in Sri Lanka

SLT-Mobitel, the nation’s ICT and Telecommunications Service Provider recently partnered with Spotify, to mark their launch in Sri Lanka. Spotify is a paid premium music streaming app which allows subscribers to listen to music to their hearts content. Both, SLT-Mobitel Post-Paid and Pre-Paid customers will now be able to enjoy Spotify by activating a monthly recurring subscription or one-time subscription plan and access unlimited music streaming and downloading facilities.

The subscription charges will get added to the user’s customary billing, where payment will be deducted in real time. Starting from the payment date, the user will be able to access Spotify and download their favourite songs, for the next 30 days. Users who sign up for their first monthly subscription will receive an additional one month, courtesy of Spotify. The one-month subscription plan is not applicable with one-time subscription plans. SLT-Mobitel data rates, depending on the user’s respective broadband charges, will apply.

Spotify also has some exciting features that will provide SLT-Mobitel customers with the opportunity to listen to ad-free music, access millions of uninterrupted music under one platform, play any song they like, anywhere they go, and also be able to enjoy their music offline.

SLT-Mobitel customers can select their preferred premium package under four categories; Individual, Duo, Family, Student. Each category has recurring and non-recurring plans. After one month of free streaming, the package will activate once the offer period terminates. While both, the Individual and Student premiums are limited to one account user, the Duo package offers two accounts and the Family premium is accessible through six accounts. To view Spotify plans, users can log on to https://spoti.fi/3aLWvce

Business

Sri Lanka using ‘sovereign power’ over economy: CB Governor

by Sanath Nanayakkare

Anyone conversant with the elements of a political economy would know that Sri Lanka is using its ‘sovereign power’ to manage the different dynamics of the economy in a sustainable manner, Professor W. D Lakshman Governor of the Central Bank said on Wednesday.

“Some critics are saying that we adopt a so-called modern monetary theory. That’s not the case. In fact, Sri Lanka is using its sovereign power in a number of economic aspects to honour its external debt repayment commitments as well as to reduce its debt burden in the medium term as well as achieve resilient growth in the medium to long term, he said.

“We make policy decisions to boost our gross foreign reserves, meet our external debt servicing, to facilitate monetary expansion, to boost our GDP growth, to strengthen our current account balance and manage our domestic and external economic variables in a sustainable manner. This is not a modern monetary theory. This is an age-old tool used by central banks around the world when the circumstances demand it, he said.

“Certain trade-offs will be necessary when dealing with an economy which has a big fiscal gap to bridge. There are efforts to push Sri Lanka towards the IMF again which would in turn have influence on our policymaking. We have taken policy measures to stabilize the economy and we have adequate reserve levels to meet our debt repayments. Meanwhile, we are in negotiations with overseas central banks and multilateral agencies to further boost our reserve level and it would materialise within a matter of weeks,” he noted.

“One of the tools the Central Bank has introduced is in respect of repatriation of export proceeds into Sri Lanka and conversion of such proceeds into Sri Lankan rupees in order to strengthen the foreign exchange situation of the country,” he said.

The Governor made these remarks while delivering the keynote speech at a webinar organised by the Veemansa Initiative led by its Managing Director Luxman Siriwardene – the former Executive Director of Pathfinder Foundation.

The webinar revolved round the topic ‘External debt situation in Sri Lanka: Are we heading for a resolution or crisis?’

Professor Sirimal Abeyratne, Prof. Sumanasiri Liyanage, Dr. Nishan de Mel and Dr. Ravi Liyanage were the other speakers on the panel.

Business

CSE on the rebound; indices close positive

By Hiran H.Senewiratne

CSE produced signs of a rebound yesterday with both indices closing positive, though turnover remained low. Central Bank Governor W.D Lakshman’s recent statement on managing foreign reserves gave some boost to the market yesterday, stock market analysts said.

The index experienced a zigzag movement within the early hours of trading; thereafter, it recorded a slight up-trend as it reached its intraday high of 7,439. Later, the market witnessed a down-trend at mid-day, followed by a sideways movement and closed at 7,372, gaining 43 points during the month of February, market sources said.

It is said the banking sector dominated turnover with a contribution of considerable parcel trades in Sampath Bank, Commercial Bank and HNB.

Further, the Commercial Bank’s impressive quarterly results during the recent turbulent period also built investor confidence. Commercial Bank was able to register a18 percent net interest income when other banks were reporting a decline. Its share price increased by Rs. 3 or 3.5 percent. On the previous day, its shares started trading at Rs. 85 and at the end of the day they moved up to Rs. 88. Due to the positive growth results, the bank announced a Rs. 4.40 dividend per share, plus a Rs. 2 script divergent for every share.

Further, Sampath Bank shares also appreciated in both crossing and retail. In crossings its shares appreciated by Rs. 1.At the end of the day they moved up to Rs. 154.50. In the retail market, its shares moved up by Rs. 2 or 1.3 percent. Previously, its shares fetched Rs. 154 and at the end of yesterday they moved up to Rs. 156.

Amid those developments, both indices moved upwards. The All Share Price Index went up by 104.48 points and S and P SL20 rose by 67.78 points. Turnover stood at Rs. 3 billion with four crossings. Those crossings were reported in Sampath Bank, where 3.9 million shares crossed for Rs. 602.2 million, its share price being Rs. 154.50, HNB 375,000 shares crossed for Rs. 39.4 million, its shares traded at Rs. 105, Pan Asia Power 9.5 million shares crossed for Rs. 33.2 million, its shares traded at Rs. 3.50 and Access Engineering 1.2 million shares crossed for Rs. 28.2 million; its shares traded at Rs. 24.

In the retail market top five companies that mainly contributed to the turnover were, Expolanka Rs. 450 million (10 million shares traded), JKH Rs. 205 million (1.3 million shares traded), Browns Investments Rs. 199 million (34.9 million shares traded), Sampath Bank Rs. 191 million (1.2 million shares traded) and Dipped Products Rs. 137.7 million (2.8 million shares traded). During the day 101 million share volumes changed hands in 18046 transactions.

During the day, Expolanka, the biggest contributor to the turnover, saw its share price appreciating by Rs. 6.20 or 15 percent. Its share price quoted on the previous day was Rs. 41 and at the end of trading yesterday it moved up to Rs. 47.

Sri Lanka’s rupee quoted wider at 193.50/195.50 levels to the US dollar in the spot next market on Thursday while bond yields remained unchanged, dealers said. The rupee last closed in the spot market at 194.50/195.00 to the dollar on Wednesday.